Does the idea of an early retirement seem far-fetched to you? (3 reasons why it shouldn't)

I've had many opportunities to share my thoughts on the idea of retiring early.

Just these past few weeks, newspapers, a radio station and a news channel reached out for a comment or two.

It seems to be a hot topic among expat investors.

Here's my take on the movement...

And how the principles can benefit anyone.

Working in financial planning, I've met many investors whose sole purpose is to 'live richly'.

For them, investing is more than growing their wealth.

It's about the opportunities their wealth can afford them.

They want to be able to tick items off their bucket list as soon as possible.

While they're still young and active enough to do so.

It's not about making the most of their golden years.

But making the most of their best years.

You can listen to my thoughts in this radio interview on Dubai Eye...

David, a 41-year-old client, shared his personal story when we met.

He told us how, on his 30th birthday, he set out to achieve financial freedom at 45.

All his friends and family said his goal seemed far too ambitious.

Nevertheless, he set a retirement income target of £60,000, for him and his wife, and assumed they’ll both live until they’re 80.

That gave him a target of £2,100,000 which he needed to save over 15 years.

He knew reaching this would come down to the right investments, the magic of compounding and spending less than he earned.

Did he achieve his goal?

Yes - partly due to his savings and partly due to his retirement planning.

He was prudent.

He knew that retiring early meant his money would need to stretch even further.

So instead of stopping work all together...

He and his wife opened a quaint B&B in the UK which will continue providing them with a steady stream of income for many years.

Most importantly, their lives are their own now.

They have freedom many of us would dream of.

Like many other early retirees...

It's less about retiring fully and more about having extra time.

It's a fascinating concept.

So what are the principles and how can they be incorporated in to your life?

1. Have a goal and stick to it

Early retirees all had a goal which they worked towards every day.

They shifted their lives to make these goals possible.

Some downsized homes, started second businesses, sold their cars and took fewer holidays.

We can learn from their dedication and commitment.

Every investor knows the importance of having a goal.

Having something that drives what you do.

For most of us, that is retirement.

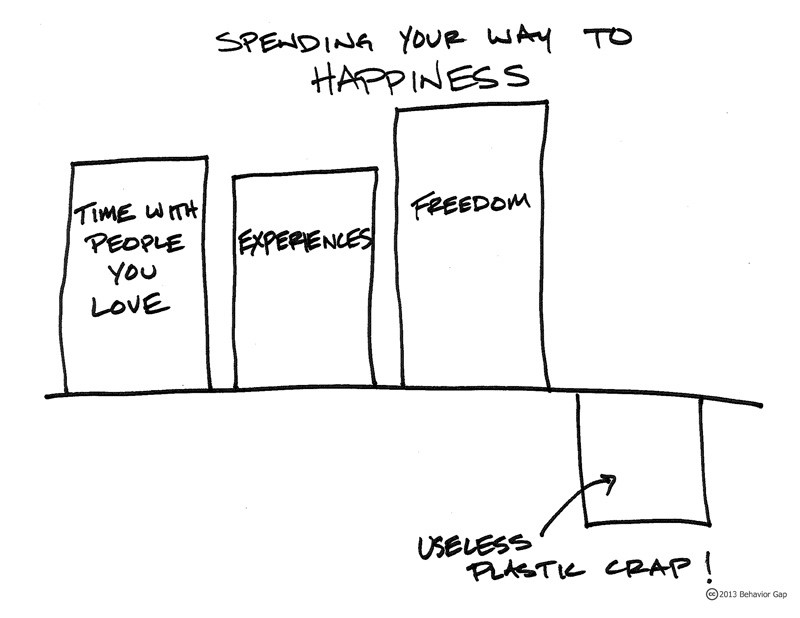

It's about finally having the time to do things you couldn't do before.

Spend more time with the people you love.

See places you haven't been able to.

Enjoy experiences you haven't yet had.

One thing I always remind investors is that your goals need to be realistic.

The more realistic they are, the easier you can stick to them.

There's no point working towards something that requires too many sacrifices.

You need to enjoy today as much as tomorrow.

2. Spend less than you earn

I spoke about the 50/30/20 rule before.

50% of your salary is spent on needs...

Things like housing, insurance and medical.

30% goes towards wants...

This covers discretionary spending like entertainment, cellphones and clothing.

20% goes towards saving.

If you want to cut down on your expenses, a good place to start is by looking at your housing.

How much are you spending on your mortgage or rent?

Can you find more affordable insurance?

Then, start looking at your discretionary spending.

Do you really need to eat out three times a week?

Can you go without upgrading to the new iPhone 11?

Every little bit counts and, overtime, these small additions to your savings will compound exponentially.

3. Invest wisely and systematically

Your investment is key to helping you reach your ideal future.

But make sure it's working for you and not against you.

I mentioned the power of compounding earlier.

Now imagine what happens when hidden charges and costs are left to compound over time...

It can devastate returns.

Are you confident you know exactly what you're being charged on your investment?

Do you know how your financial person is getting paid?

These are vital questions to ask.

I'm sure those who managed to retire early and reach their financial goals were able to do so because they knew exactly how their investments were structured.

They understood that in order to have the best possible chance at inflation-beating returns...

They needed a globally diversified portfolio of low-cost funds...

And a fee-based financial planner who puts their clients' needs first before anything else.

Then they invested as much as they could...

As often as they could.

And always kept their focus on their ultimate goal.

Does this sound like you?

Or do you need a little help?

Wherever you are along your investment journey, give us a call.

We're here to help investors get their financial house in order.

And help them reach their future goals.