[Estimated reading time: 5 minutes, 45 seconds]

My wife Kate has no interest in financial services.

But the other day, she asked me if I knew who Jack Bogle was…

As founder of The Vanguard Group and inventor of the index fund, of course I know who Jack Bogle is.

The question is – how did she?

His wisdom reaches far and wide – it was in an article she’d read about not raising spoiled brats.

He condensed his 7 best investment tips into another article – Balancing professional values and business values.

The tips explain how you can work less and make more money:

#1 You must invest

“The biggest risk facing investors is not short-term volatility but, rather, the risk of not earning a sufficient return on their capital as it accumulates.”

Over the last 8 years, the typical UK bank savings account has attracted an average of 2.08% interest per year.

In that same time (starting 2009) UK inflation rates have averaged 2.22% per year.

In other words, the average saver has been losing money for the last 8 years.

In contrast, if you adjust the S&P500 for inflation, and account for dividends, it’s returned investors an annual average of 7.0% - every year since 1950.

The moral of the story?

If you want to grow your wealth, you must invest.

#2 Time is your friend

“Investing is a virtuous habit best started as early as possible. Enjoy the magic of compounding returns. Even modest investments made in one’s early 20s are likely to grow to staggering amounts over the course of an investment lifetime.”

Someone who invested £1,200 at the beginning of 1970, and added the equivalent of just £3 a day thereafter, would have added £56,400 by the end of 2016.

But, if they earned the average return of the global stock index (9.67%) they’d have grown their wealth to more than £1.1 million today.

Know that for every 7 years you wait to invest, you must invest twice as much money per year to end up with the same amount.

Because you'll never be younger than you are right now, start investing today.

#3 Impulse is your enemy

“Eliminate emotion from your investment program. Have rational expectations for future returns, and avoid changing those expectations in response to the ephemeral noise coming from Wall Street. Avoid acting on what may appear to be unique insights that are in fact shared by millions of others.”

Most investors, especially men, fall victim to their emotions.

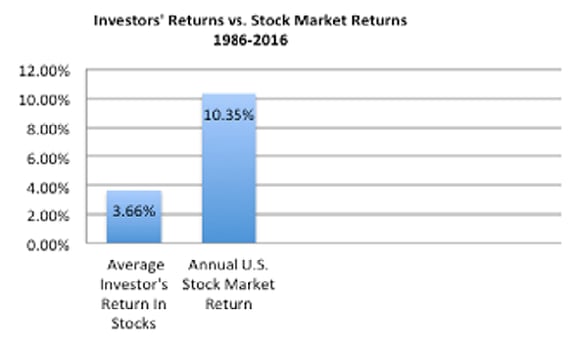

The difference is especially striking over the trailing 30-year period.

The average equity investor earned a hair below 4.0% a year while the S&P deliver a bit more than 10%.

Irrational behaviour did most of the damage.

In other words, investors pay a high price when they act on their emotions.

#4 Basic arithmetic works

“Net return is simply the gross return of your investment portfolio less the costs you incur. Keep your investment expenses low, for the tyranny of compounding costs can devastate the miracle of compounding returns.”

The more you pay in investment fees, the less you get to keep.

Consider the example of two senior international professionals, Sam and Stuart.

Both are 35 years old, and each has saved £100,000 which they decide to invest.

Over the next 30 years, each achieves a gross return of 8% a year.

Sam does it by investing in the Index Account; it costs him 1.75% a year in fees.

Stuart does it by owning the typical expat portfolio; it costs him 4.91% a year in fees.

By the age of 65, Sam has seen his portfolio grow from £100,000 to approximately £592,501.

As for Stuart, his £100,000 has only grown to £222,207.

They both achieved the same rate of return, but they paid different fees.

The outcome?

Sam has an additional £370,294 for his retirement.

#5 Stick to simplicity

“Basic investing is simple—a sensible allocation among stocks, bonds, and cash reserves; a diversified selection of middle-of-the-road, high-grade securities; a careful balancing of risk, return, and (once again) cost.”

Investing isn’t speculating, and needn’t be complicated.

It can be as simple as investing every month without fail, in a globally diversified portfolio invested in the world’s greatest companies – and staying invested no matter what.

There's genius in such simplicity, and money to be made because of a financial concept called ‘pound (or dollar) cost averaging’.

That’s when an investor invests an equal amount every month or quarter without fail.

Author Andrew Hallam explains exactly how in his article - how to take less risk and earn better returns.

#6 Never forget reversion to the mean

“Strong performance by a mutual fund is highly likely to revert to the stock market norm—and often below it. Remember the Biblical injunction, “So the last shall be first, and the first last” (Matthew 20:16, King James Bible).”

Investment research company Morningstar helps investors choose which funds to invest in, by giving each fund a star rating.

They base their ratings on how well a given fund has performed.

In terms of Morningstar’s ratings, one star means a fund is underperforming, and five stars means a fund is an out-performer.

In 1999 Morningstar gave 248 funds a five-star rating.

A decade later, because of the inevitability of reversion to the mean, only four funds maintained their five-star rank.

#7 Stay the course

“Regardless of what happens in the markets, stick to your investment program. Changing your strategy at the wrong time can be the single most devastating mistake you can make as an investor.”

During the financial crisis of 2008-2009, the S&P500 lost approximately 50% of its value.

Many investors couldn’t stand the heat and fled the market.

However, the recession ended in 2009, the S&P500 bounced back, and investors who’d fled paid a high price for their retreat.

To date, since the market bottomed out in March 2009, the S&P500 has rebounded 266%.

As Bogle says - “Stay the course” is the most important piece of advice I can give you.”

If you take the above advice to heart, I guarantee you’ll be able to work less and make more money.