I was poached for a job the other day.

The CEO of a financial services firm tried tempting me with a lucrative offer...

Up to 17% commission on all products sold.

That's 17% of someone else's investment...

Straight into their pockets.

Baffling, to say the least.

I didn't bother replying to the message.

But the reality is, many salespeople will.

And many investors will lose money because of it.

As long as commission schemes like this one exist...

The international financial services industry will be shark-infested waters for many unknowing global investors.

Financial planning education is vital.

The only way to avoid becoming a victim is to arm yourself with as much knowledge and information as possible.

To start with, get your head around the different ways you can be charged.

Because certain charges can be detrimental to your investment.

The years you spend saving could amount to nothing at the end.

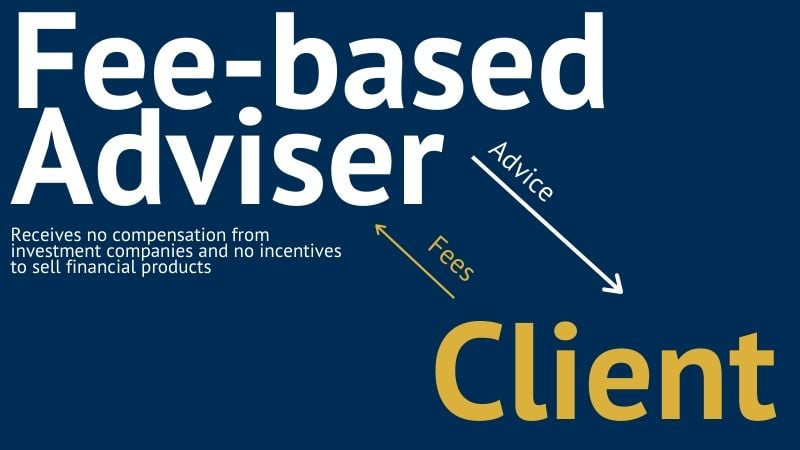

1. Fees

In some countries, advisers charge fees.

They are charged to you, the client, for the advice you get and the time the adviser spends helping you.

In the UK all advisers charge their clients fees.

In some countries you also pay an ongoing fee to your financial adviser every single year.

This is called 'fee-based advice', and the adviser has a fiduciary duty to give advice and act in your best interest.

This is truly independent advice because it is given free from the conflict and bias of being paid by someone other than you, the client.

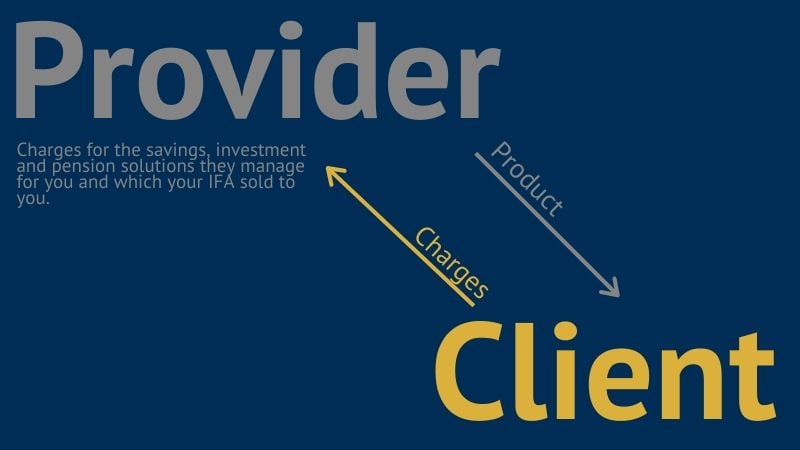

2. Charges

Financial product providers also charge for the savings, investment and pension solutions they manage for you and which were sold to you.

These charges are charged to you, the client, and deducted from your account each year.

You also pay charges in the form of the cost of the funds that make up your investment portfolio or offshore investment bond.

A product provider will use the terms ‘charges’, ‘fees’ and ‘costs’ interchangeably.

They all relate to the money you pay them for their work and the underlying investment charges you also pay.

A simple-sounding 'offshore pension' from even well-known offshore life insurance companies may take annual charges including management costs, establishment costs and mutual fund management costs.

These are taken every single year for the duration of your policy.

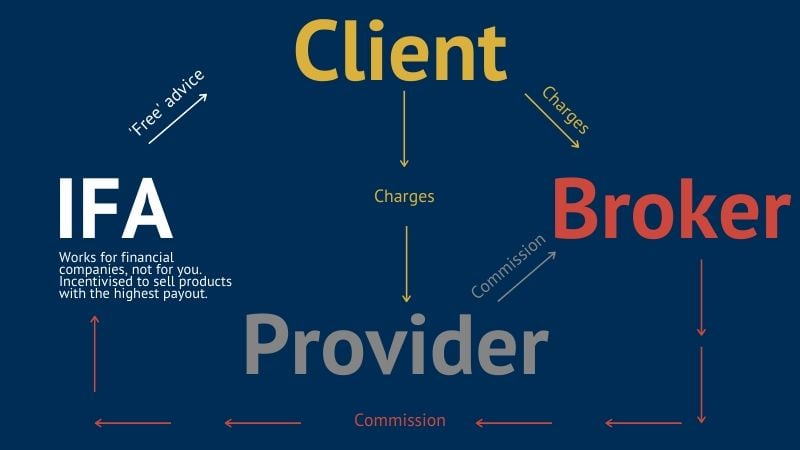

3. Commission

If you don’t pay your adviser any fees (and, most expat financial advice is described inaccurately as 'free'), then the offshore brokerage the salesperson works for pays him.

The broker gets the money to pay the salesperson from the commission the salesperson earned selling the product (and the funds within it) in the first place.

This commission is paid by the product providers and the underlying fund companies to the broker.

The broker pays a large chunk of that commission to the financial salesperson and retains the rest.

The product provider and investment providers take the commission they pay to the brokerage from you - usually over a period of years.

This causes lock-in periods and exit penalties that restrict your flexibility and erode your returns.

It really is "win win", for everyone involved...

Except you.

Internationally, the minimum amount that commission-based business is worth is 7% of your investment value.

Sometimes this can go up to 20%.

And, the average amount taken in initial commission in the Middle East and Asia is 12%.

This adds up to thousands of pounds.

All taken from you.

Why it matters what you pay

Most investors never realise all this hidden commission weigh down their investment performance.

Not only do hidden commissions mean the salesperson may have been incentivised to sell you the wrong product and wrong investments in the first place...

But the layering of charges literally reduces the amount of your money available to be invested for growth.

You need to add up the total running cost of any saving, investment or pension product you hold in order to see whether it can ever be profitable.

If we take Warren Buffett’s widely accepted truth that the stock market will return an average of 6 or 7% over the long-term, then your total running costs need to be well below that figure for you to make any meaningful returns.

The trouble is, most expats pay more in total running costs than their holdings earn.

How to work out what you pay

This might sound boring but trust us – paying attention here will make a very big difference to the money you get in the future.

For every policy and product you have you need to identify the following:

- The financial salesperson's/brokerage’s commission

- The policy provider’s charges

- The underlying investment charges (including the fund ongoing charges figure (OCF) and investment fund bid/offer spread)

- Any fees you paid for financial advice

- Any fees you pay to your adviser on an ongoing basis

Add these up and where necessary average them out over the term of the policy.

Then, look at your product’s performance and see whether you’re making a profit.

Or, whether your fees, charges and commission are costing you too much.

Once you know what you’re paying and what your returns are, you can see whether you need to cut your costs to increase your profits.

How to pay less

- Avoid commission-only financial salespeople – their service costs more, even though they're hard-sold as ‘free’

- Know that in investment terms, complicated solutions cost more, deliver less and pay 'IFAs' the most commission

- Consider taking a passive approach to investing via low-cost, low maintenance tracker funds held for the long-term

What next for you?

- Discover the 6 steps to investment success;

- Find out whether you're going to be okay

- See what you pay in fees as our client or;

- Take advice from our Chartered Financial Planners who adhere to the Chartered Insurance Industry’s Code of Ethics.