How one oil and gas professional unknowingly paid his 'adviser' £210,000 in commission

Every now and then I come across cases that simply blow my mind.

I'll always remember this one in particular because I couldn't help turn things around.

That's the reality of life though, isn't it?

We can't help everyone.

Here’s the full story.

From experience, I’ve realised:

Not everyone is going to take your advice.

It’s even harder when you know for a fact someone’s going to lose a lot of money.

You can only show them the evidence of how an investment may or may not be right for them.

The decision at the end of the day must be theirs – not yours.

But this story is not about you or me.

It’s about Pete, an oil and gas professional in Baku.

I hope his story inspires you to take action today so you can have better clarity, confidence and control over your finances.

Pete wanted to retire in Cyprus and had a huge pension from an entire career at BP.

He’d been contacted by someone who flew out to Baku and explained the benefits of a pension transfer over a few drinks.

(If you read my blogs, you know this should have set off a few alarms).

Afterwards, Pete asked me for a second opinion.

I told him the recommended solution wasn’t only dire but criminal in the UK.

I showed him the evidence.

Yet he responded with:

“It all sounds like the same gobblygook to me - the guy seems trustworthy enough.”

It was an unexpected turn of events.

Why did he seek a second opinion in the first place?

Second opinions are not validations.

They should be backed by science.

They’re not mean to support your decision but offer real, unbiased insight into whether an investment will work for or against you.

What happened next?

Pete ignored my advice, transferred his pension and paid the salesperson over £210,000 in hidden commission.

More than enough for a nice retirement villa in Cyprus.

But worse, he locked himself in a 10-year bond, full of structured products that have, and will continue to, lose him hundreds of thousands of pounds more.

Pete is 52 and had hopes to retire in five years' time.

However, given the damage made to his pension, he now faced a fork in the road.

1. Does he work longer and extend his retirement date to try make up his losses? Or...

2. Does he retire at 57 and downsize his lifestyle to save on living expenses?

It's a difficult situation and one I couldn't help to fix when Pete emailed me a few months later.

He didn't know where else to turn to help salvage what was left of his pension.

There was nothing we could do but offer advice.

We suggested he consider extending his retirement date by at least another five years so he could save more of his salary and sell a few of his emotional assets to free up more capital.

This should then be invested into a globally diversified portfolio of stocks and bonds.

Given the power of time and compounding, he should hopefully have enough to cover his bills in retirement.

So, who can you trust with your money?

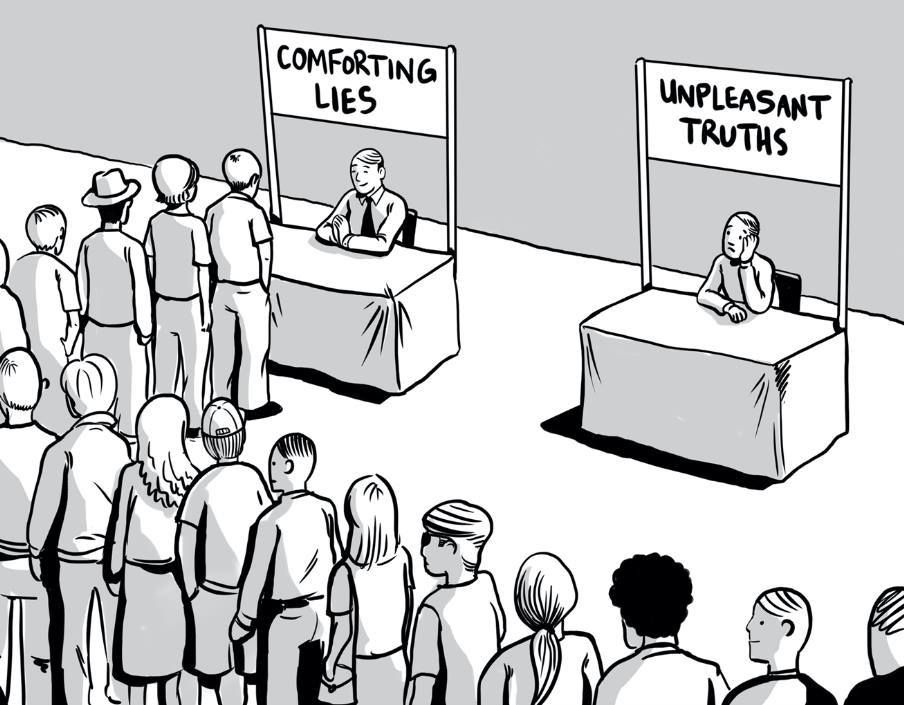

Before you can answer that, you need to know how to differentiate between the two main types of financial advisers – fiduciaries and brokers.

- You can’t tell by job title alone.

- Fiduciaries are harder to find but they’re the only ones required to act in your best interest.

- Brokers are the vast majority but they are paid to sell you stuff.

- Brokers often walk away with bags of hidden commission generated by locking you into long-term plans (like Pete).

- Brokers are not required by any law, regulatory body or professional standard to act in your best interests.

Tony Robbins, the best-selling author of Unshakeable, explains this conflict of interest in 5 short quotes:

“Brokers don’t have to recommend the best product for you. What?! Yes, you heard me right.”

“Brokers and their employers earn more by recommending certain products.”

“No matter how much you like your broker, your broker is not your friend.”

“How is it that profits over people has become the accepted standard?”

“Does it sound like there’s a conflict of interest here? Damn right!”

The ‘ignorance is bliss’ proverb means:

“If one is unaware of an unpleasant fact or situation, one cannot be troubled by it.”

Pete was ignorant of the difference between a broker and a fiduciary.

He didn’t know the signs to look out for:

- That a round of drinks or golf could be the biggest sales tactic of all.

- How investments that sound too good to be true are probably wrought with layers of hidden charges.

- How face-to-face financial advice doesn’t mean better advice.

While his story is unsettling, you shouldn’t be worried.

You’re already taking the necessary steps to educate yourself on the world of financial services.

You know that knowledge equals clarity, confidence and control.

After all, you’re here and reading this.

On a more positive note…

Not all true financial stories are meant to scare you.

Some also inspire and show what focus, perseverance and the right plan can do for you and your family's goals.

Despite the tumultuous year in 2020, one investor managed to weather the storm and earn incredible returns.

In fact, unlike Pete, he may even be able to retire earlier than expected.

Whether you're anxious about your future, want to live life to the full or ensure you're family's looked after; the same principles always apply:

1. Save more than you spend

2. Invest now rather than later

3. Ensure your portfolio is globally diversified

4. Control your costs

5. Be patient and let time and compounding work for you

I hope this blog helped you think about your own goals and the steps you're taken to work towards them.

If it did, make sure to subscribe to receive more.