The 60/40 portfolio had a hard time offering investors much support last year. Is it still relevant?

In September, I published an article on the 60/40 portfolio and why I was convinced it remains the benchmark to beat.

Here's why I stand by this. Despite personally opting for a higher equity allocation with my own investments (I have a long time horizon, hold an enduring belief in the power of capital markets and have been an investment professional for almost 20 years)...

I'd still recommend this portfolio if it suits your situation.

Before we dig in, let's take a moment to think about asset allocation.

Building a solid portfolio is very much like building the pyramids.

Ancient Egyptians built pyramids for keeping the family treasures, and they were designed to stand the test of time.

I look at asset allocation in the same way.

There's no denying the 60/40 portfolio has had a bad time recently.

Some said that 2022 was the portfolio's worst year ever.

Putting 60% of a portfolio in stocks and 40% in bonds is supposed to hedge against both assets dropping simultaneously.

But it didn’t pan out that way in 2022.

The portfolio had a hard time offering much support in either asset category, leading some to question if it's still relevant.

The US market can help, as it offers the longest continuous data set.

During rocky markets, it's especially important for investors to focus not solely on where returns have been but also on where they could be going.

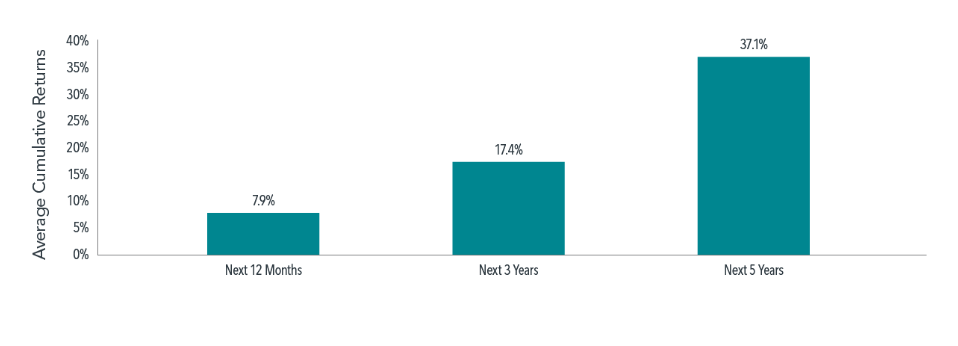

Looking at the performance of a 60/40 portfolio following a decline of 10% or more since 1926, returns on average have been strong in the subsequent one-, three-, and five-year periods, as this chart from Dimensional shows:

Although 2022 was the worst year in history for many bond indices, the performance of the 60/40 portfolio didn’t enter the top five peak-to-trough drawdowns in close to a century’s worth of data.

The ancient Egyptians would be proud of this.

Of course, the drawdown that reached 19% at its lowest point was painful, but it’s only two-thirds of the 30% peak-to-trough drawdown investors experienced in 2007–2009.

And the portfolio saw some recovery late in the year, ending down 11% for 2022.

It's about taking a balanced view of the 60/40 portfolio.

It's stood the test of time.

The 60/40 won't be right for every investor.

As I explained, it’s not right for me.

But when it comes to which asset allocation is right for you, your family treasures may need the same sort of care and protection the pyramids provided all those years ago.