Proof that diversifying your investments is a no-brainer (PLUS two types of products to avoid like the plague)

Guest post from Robin Powell of The Evidence-Based Investor blog...

If there’s one thing we’ve learned from more than 60 years of academic research, it’s that diversifying your investments is a very good idea.

Not only does it reduce risk, but it can also improve your expected returns.

What’s more, it gives you a smoother ride towards your investment goals, greater peace of mind and security.

Failing to diversify exposes you to concentration risk.

You’re creating a bumpier investment experience making you prone to second-guessing your investment decisions.

This in turn causes unnecessary costs.

Lower returns.

Increased anxiety.

The question then is how to diversify.

The answer, simply, is to buy the funds you need rather than the funds the investment management industry wants to sell you.

And, to find a solution that gives you the highest net returns when you come to retire rather than one that means sharing a large chunk of your returns with others.

Don’t be misled by the fund management industry

The fund management industry likes to give the impression that active funds can somehow provide “downside protection”.

That they can maximise your expected returns while also reducing your risk.

It’s nonsense.

The data shows that active funds perform no better in bear markets than in bull markets.

As you’d expect from the law of averages, some active funds do perform better than the index when stock markets fall.

Usually, though, this has less to do with skill than with what’s called ‘style drift’.

In other words, reducing exposure to equities.

Most actively managed equity funds also include a small amount of cash, bonds or both.

When diversifying, there are two types of products to avoid.

#1. An actively managed multi-asset fund

Typically, these funds describe themselves as “strategic”, “tactical” or “dynamic”.

Because they switch between different asset classes as and when the fund manager sees fit.

The evidence shows that this sort of market timing doesn’t work.

And that professional money managers are little better than ordinary investors at buying and selling at the “right” time.

It’s almost impossible to tell which asset class is going to do best or worst in any one year.

So, the logical course is to stay broadly diversified consistently and for the long term.

Crucially, active managers also charge high fees and pass on the cost of trading to the investor.

These fees have a hugely detrimental impact on long-term investment returns.

#2. A multi-manager fund

Even worse than strategic multi-asset funds are so-called multi-manager funds.

The PR and marketing for these products makes them sound wonderful.

Who wouldn’t be tempted by a single fund which gives you access to “the very best managers”?

The problem again is that while anyone can tell you which funds have performed well in the past, it’s almost impossible to predict the star managers of the future.

An on-going study by The Pensions Institute, based at Cass Business School in London, has concluded that the vast majority of fund managers are "genuinely unskilled".

And that even those very few managers who do beat the market consistently...

“Extract the whole of this superior performance for themselves via their fees, leaving nothing for investors”.

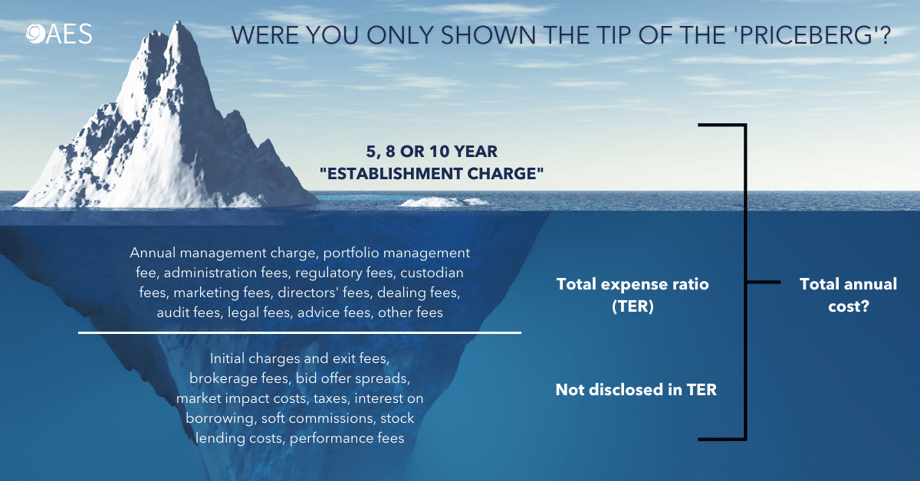

Indeed, the fees on multi-manager funds are even higher than for multi-asset funds.

Effectively they layer fees on top of fees.

A priceberg.

That means they’re great for fund managers and for brokers, who earn a fortune from them...

But they’re generally a very bad deal for investors.

The cheapest and most efficient way to diversify

The answer is to invest systematically in a broad range of low-cost index funds covering all the main geographical regions, and bonds as well as equities.

You may also want to invest in value stocks or small companies, again using passively managed funds.

You also need to remember that, because different assets perform differently, the initial weighting of your portfolio will drift over time.

As equities outperform bonds over the long term, a portfolio will generally become riskier.

It’s usually a good idea, therefore, to rebalance your portfolio, perhaps once a year, to restore the original asset allocation.

Finally, don’t forget cash.

Everyone should have at least three months’ salary saved in cash, which they can access easily in an emergency.

Those who are particularly anxious, and those on the verge of retirement, should probably have a larger cash reserve than that.