Steve Jobs made many powerful statements.

But one sticks out for me.

The founder of one of the world’s most successful tech companies said:

‘Technology is nothing.’

It’s not as ironic as it sounds.

Within wealth management, a lot has been made of machines taking over from humans.

The so-called ‘robo-adviser’

But technology on its own often fails to achieve complete results.

Take airline travel for example.

Booking a flight online is simple and convenient.

But it’s a different story when a flight is cancelled.

You may be left desperate to speak to a human.

And not a chat bot or automated phone system.

You want human reasoning and understanding.

In the words of American writer and philosopher, Robert M. Pirsig:

“Technology presumes there’s just one right way to do things and there never is.”

While it certainly improves our lives and automates processes…

It does not have all the answers.

So, what’s the alternative?

The combined power of humans AND technology.

A ‘cyborg’ approach - not a robot.

More like Robo-cop than the Terminator.

Technology’s role in wealth management

Automated investment platforms have made it easier for us all to save.

They are forecasting to manage approximately 10% of all global AUM by 2020.

Equating to approximately $8 trillion.

It’s clear they are becoming more prevalent.

I am a big fan.

They make it easy to avoid the expensive and inflexible products flogged by financial salespeople who prey on unsophisticated investors.

The way they work is simple:

Answer a short questionnaire and an algorithm suggests a portfolio for you.

Anyone with similar answers to yours gets the same set of investment options.

Regardless of their lifestyle or retirement dreams.

This one-size-fits-all approach doesn’t suit all investors.

Those with more complex financial needs cannot be supported by an app or questionnaire alone.

Most High Net Worth Investors, for example, still prefer their human wealth managers.

Investors looking for advice on the latest investment vehicles…

(Like cryptocurrencies for example)

Will also find technology unable to offer the perspective, wisdom and experience of a human financial adviser.

Technology can’t make judgment calls

Saving for retirement is an emotional process.

It’s linked to people’s hopes and dreams.

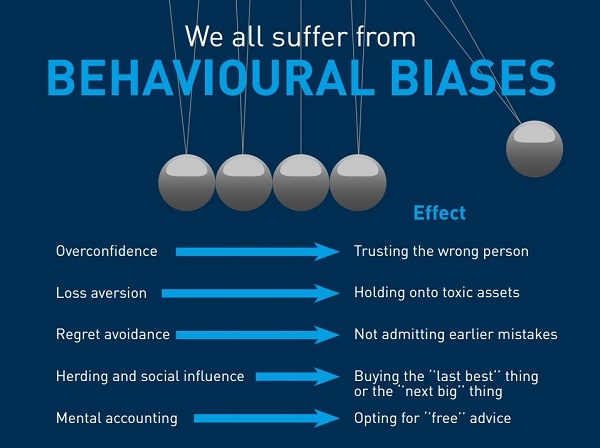

But too much emotion can lead to irrational decisions and actions.

Some claim that technology helps alleviate this by automating your investment decisions.

Making you less likely to buy, sell or withdraw on a whim.

While true in theory, investing cannot be that cut and dry.

In the last few years, we’ve been in a raging bull market with relatively low volatility.

Investors are pleased with their returns.

But what goes up must come down.

At some point in time, we will see a bear market.

Emotions will kick in and irrational behaviour will take over.

Investors will want to pull their money out at the wrong time.

(If they can remember their login details…)

This is where the human touch can help.

To alleviate emotional decisions.

To educate.

Trying to time the market is scientifically proven not to be a long-term success strategy.

In fact, it can destroy retirement plans.

Humans and technology – what’s one without the other?

In the humans vs technology debate, the reality is:

Neither one on its own is truly effective.

In the world of wealth management, they work in tandem to provide comprehensive advice.

Tools and online systems help to comb through extensive and complicated data.

Reducing costs and giving a simpler view of a client’s finances and interests.

This helps advisers use their time wisely and more effectively to plan, guide and advise.

Without sales spin.

Or sifting through endless information.

When it comes to humans and technology, we see the definition of a symbiotic relationship.

“Symbiotic relationships are a special type of interaction. They provide a balance that can only be achieved by working together.”

If you want help reducing complexity, evaluating different trade-offs, or just a second opinion on your current portfolio, get in touch.

We’ll use scientific evidence and sound human judgment to provide better results – nothing less.