Do you find it hard to block out the noise in the financial media?

Are you second-guessing the investment decisions you made in the past based on what's happening now?

It’s something a lot of investors struggle with.

But it’s important that we periodically take a step back to remember the fundamentals, and why we trusted the market enough to start investing in the first place.

1. Over the long term, there’s no historical event that the stock market hasn’t overcome

Wars, recessions, and pandemics to name a few.

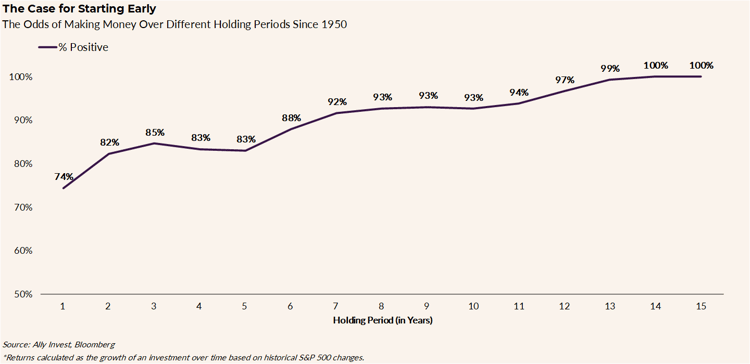

The chart below illustrates why we always talk about investing for the long term.

While it may be the case that the stock market usually goes up, it doesn’t always.

Investing for long-term returns means being able to stomach a lot of intermediate volatility.

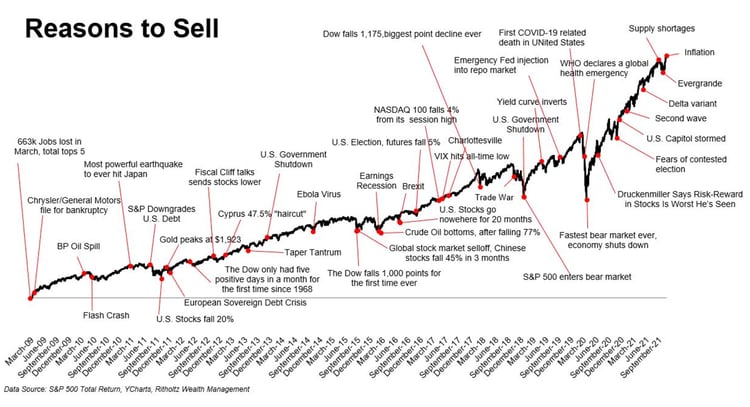

2. Yet, there’s always something you’re told you need to worry about

I think we’re generally cognisant of the idea that bad times are temporary, and progress is undefeated, but it’s still so hard for us to accept volatility.

This leads us to make financial decisions that are detrimental to our future selves.

A lot of this is the result of human nature, but also by being influenced by near-constant bad news.

Bad news is events and good news is progress.

Nothing starts out amazing.

Things continue to slowly get better and better, and incremental improvements sadly don’t make the front pages.

Gradual improvements, in this case, market performance, go unnoticed and unreported.

3. It’s more or less impossible to accurately predict what will happen in the short term

Since 1980, the average intra-year decline for the S&P 500 is -14%.

At some point in the calendar year, the S&P 500 has been down this much, on average, from its previous high.

And since 2000, there have been twelve calendar years where the S&P 500 has experienced a drop of 10% or more.

It’s likely you don’t remember the vast majority of these moments looking back, but they probably felt quite painful at the time and would have been accompanied by doom-mongering in the media.

It's fair to say that bear markets are terrible.

But we can bank on human ingenuity to find a path through them.

Markets are forward-looking and reflect this optimism.

Things will always work out, but we need to accept there will be bumps along the way.

4. Not even the ‘experts’ know what the future holds

Here are the 2022 S&P 500 year-end predictions from some of the world’s biggest financial institutions:

- Barclays – 4,800 (2/12/2021)

- Bank of America – 4,600 (23/11/2021)

- BNP Paribas – 5,100 (22/11/2021)

- Credit Suisse – 5,000 (09/08/2021)

- Goldman Sachs – 5,100 (16/11/2021)

- JPMorgan – 5,050 (30/11/2021)

- Morgan Stanley – 4,400 (15/11/2021)

- UBS – 4,850 (07/09/2021)

- Wells Fargo – 5,100-5,300 (16/11/2021)

As of today (26/10/22), the S&P 500 is at 3,859.

None of the experts’ predictions, with access to endless amounts of information that 99% of retail investors don’t have, are even close to what has actually played out.

It’s incredibly difficult to predict with any accuracy where the stock market will be in a year.

In addition to the countless number of variables to consider, there are also totally unpredictable events that occur along the way.

The best way to put the odds in our favour is to make good decisions now that focus on the long term.

5. We talk in averages, but shouldn’t expect average

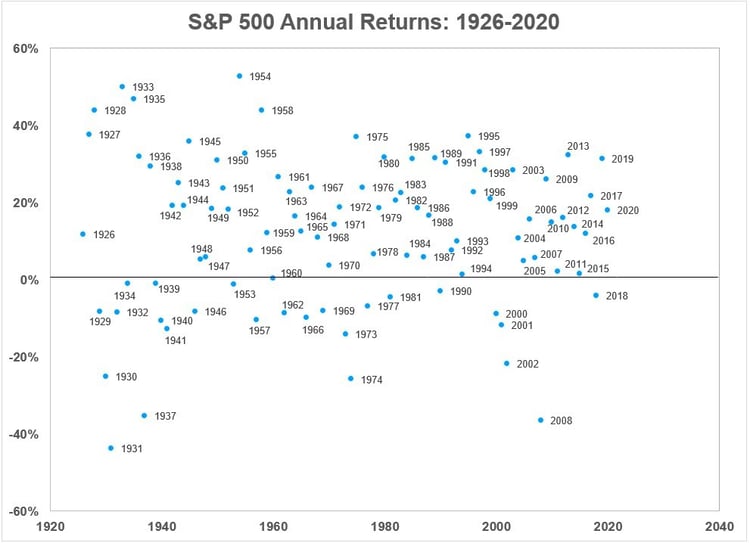

The general rule of thumb is the US stock market returns around 10% on average per year.

However, in any given year, it rarely delivers the average.

Here are the annual returns of the S&P 500 since 1926.

This demonstrates just how difficult it is to predict what next year’s returns are going to be.

It holds true even if you know exactly what’s going to happen in the economy. Which of course, we don’t.

The good news is most of the returns are above the black line…

Rather than having to guess what will happen and when I choose to carry on investing in the market.

My philosophy is to start each day believing the market will go up a little.

But I’m also comfortable if it doesn’t.

I know this is part of the game.

If I maintain this mindset for long enough, history has shown that my portfolio will grow thanks to the power of compounding.