Yes, the bear market is awful right now. But your future self will thank you for doing this one thing

My general investment philosophy is this.

The more bearish things feel, the more bullish I'll be.

Perhaps there was never a better example of this, than now.

Is there more you can be doing today, that your future self will thank you for?

The markets have been dominated in 2022 by high inflation and interest rates hikes used to combat them.

Of course, there’s a war, currency crises, energy shortages and a global economy on the brink of a recession...

But it boils down to those two things being the reason the economy is seeing a downturn, and why investors are selling left, right and centre.

I can appreciate why.

Inflation is corrosive for stocks and bonds and rising interest rates are bad for just about every asset.

Everything is falling, except cash.

Although things could get worse before they get better...

This environment is highly unusual and unlikely to last too long.

Right now, being bearish is easy.

But there needs to be some balance between being short-term bearish and long-term bullish.

Which assets should you buy?

If your investment horizon is short and you’re seeking high returns, this is the million-dollar question.

You'll have to pick the right asset because over the short-term, some assets will go up, some will go down, and very few will generate high returns.

And with all the uncertainty in the world, picking the right ones has rarely been so challenging.

But if your horizon is long, and you’ve got reasonable return expectations, then a diversified portfolio of global stocks, bonds, and other commodities should still deliver positive returns in most scenarios.

That’s because, over the long term, asset returns have to beat cash.

And over the medium term, a balanced portfolio will keep you from being overly exposed to any one environment, so you don’t need to worry about forecasting what the economy will do next.

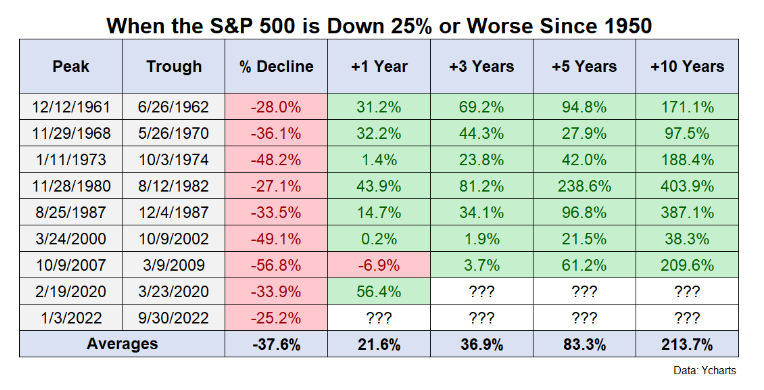

This is the 9th time the S&P 500 is down 25% or more since 1950

History provides no guarantees for the future but there is comfort in knowing that buying stocks when they’re down big like this tends to offer positive outcomes.

These are the forward one, three, five and ten year returns from down 25% over the past 70+ years in the S&P 500. Every 3, 5 and 10 year period showed positive returns while just one 12 month period was negative:

In an environment like this one, as asset prices fall, the forward returns of that portfolio rise.

Take stocks and bonds for instance.

If they were overvalued a few months ago, they are trading at a more attractive valuation now.

Those who buy at these discounted levels are likely to experience much higher returns than those who bought when prices were much higher.

Those who'll buy at even lower levels are likely to see even higher returns in the future.

How can you take advantage of this awful market?

No one will know whether prices have bottomed.

And there’s a fair chance that everything sells off a bit more in the short-term.

We don't know how much worse things will get, how much is priced into the market or how bad an economic slowdown could impact stocks going forwards.

But here's what we do know.

The stock market doesn’t fall 25-30% very often and when it has in the past it’s provided solid returns when your time horizon is measured in years as opposed to days or months.

If you've got spare cash to invest, you should look at every fall in asset prices as a possible opportunity to build a robust portfolio at discounted levels.

In the medium term, some assets will regain their footing.

In the long term, most assets should go up.

Until the data suggests differently, I shall be continuing to view downturns as an opportunity and passing the same message on to our clients.