Few people enter financial services with the express purpose of enriching people’s lives…

Traditionally it attracts ‘mercenaries’ not ‘missionaries’.

But I believe vocational professions such as medicine, teaching, or government shouldn’t have a monopoly on education and service.

Millions of investors can benefit from advice that rewards those who use financial services as opposed to enriching those who sell them.

Here are 3 simple examples.

Myth #1: Investing is complex

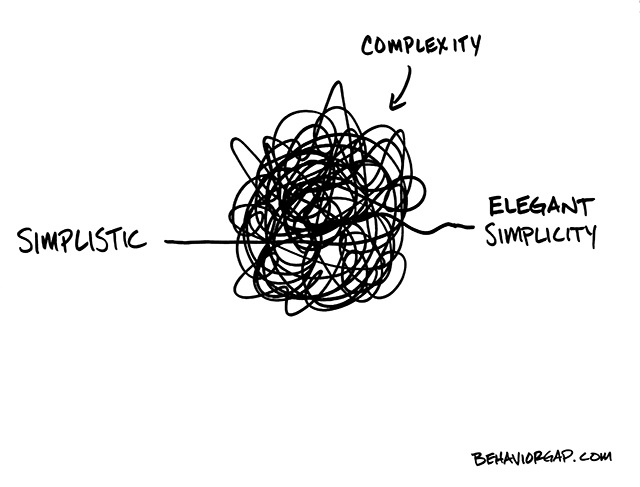

We believe ‘simple beats complex’.

It’s a principle adopted from Ben Carlson, CFA.

Complexity often harbours hidden charges.

Investors are easily misled with complicated products, too much small print and jargon.

Simplicity, on the other hand, gives way to transparency.

As Charlie Munger once said:

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.”

And what can be simpler than a long-term investment approach of leaving your investment alone to work its magic in the markets?

Myth #2: Investing is exciting

On the contrary, it’s like watching paint dry.

But the financial media and brokers make it seem different.

After all, human nature wants excitement.

We don’t want boring.

Chasing the thrill (investment wise) requires timing the market.

Chopping and changing your portfolio to outperform it…

And taking on high levels of risk at precisely the wrong times.

This is speculation (like gambling).

No one knows what the future holds.

(Definitely not a self-employed product salesperson working for commission).

Only a boring, disciplined and diversified approach wins.

Echoed by George Soros:

“If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.”

Myth #3: ‘Value add’ often isn’t

I love the work of Larry Swedroe, the Director of Research for Buckingham Strategic Wealth.

This quote in particular:

“Sadly what so many investors believe is that the value is in the investment advice, mainly choosing which funds to pick.

While that can make a difference the great value is in planning (integrating a well thought out investment plan into a well thought out life, estate, and risk management plan) and adapting the plan to the persistently changing circumstances that cause the assumptions upon which the plan is based (even time passing, life events like death, divorce, inheritance, change of jobs, etc).

Most people have not worked with true wealth planners so they don’t know where the true value is.”

The missionary value lies in enabling people to make more informed and effective financial decisions about their lives.

Enabling them to feel relieved, confident, self-assured and empowered about their wealth so they can live more fulfilling lives free from worry.

But that’s not what many mercenary salespeople will tell you.

Here are examples of “value add” that often end up as “value subtracted”. I hear them all the time:

- Picking mispriced stocks

- Timing the market

- Picking fund managers likely to outperform

- Picking alternative investments

- Picking dividend paying stocks

- Picking high yield bonds

Facts only

If you’re looking for a vocational financial professional to help you focus on what’s important, let us know.

We’ll always ensure your advice is supported by science not the spin.