Warren Buffett swears by it.

Apparently, Einstein did too.

And it’s no wonder.

Because the returns are exponential.

In order to fully explain, I turn to nature.

And those amazing phenomena…

Glaciers.

Their imposing structures…

(Not to mention beauty)…

Command attention.

What has this got to do with compounding?

They form slowly over millions of years.

One delicate snowflake after the other.

As new layers form…

Older ones are compacted…

Gradually building these awe-inspiring wonders.

Somewhat hard to comprehend isn’t it?

These enormous formations all started from seemingly insignificant snowflakes…

A freakishly small base.

An example of compounding in nature.

I love science.

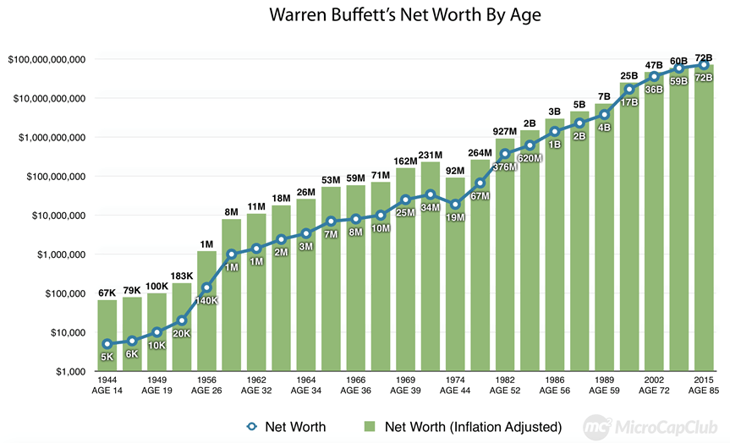

Warren Buffett has always been vocal about his love of compounding.

It’s perhaps the number 1 reason why he remains one of the world’s richest.

His fortune isn’t due to being a good investor…

(Although he is)…

It’s because he’s been investing since the age of 11.

Many of us become ambitious savers only around the age of 30…

When we’ve broken free from entry-level jobs…

And started earning more money.

But Buffett understood the power of compound interest long before that.

By the time he was 30, he had a net worth of $1 million…

Which is equivalent to $9.3 million today.

He was in the 99.99th percentile.

What if he only started investing at 22 years of age…

Straight out of college?

Using today’s net-worth percentiles…

And adjusting them for 1960s-era inflation…

He would be worth around $24,000 at the age of 30.

If he went on to earn the same returns that he did…

He would only be worth $1.9 billion.

That’s 97.6% lower than his actual net worth of $81 billion.

Don’t get me wrong, $1.9 billion is still a hefty sum…

But the point I’m making is that the difference of just 11 years…

(In terms of compounding)…

Has had an astronomical impact on Buffett’s net worth.

It’s so easy to overlook the power that something small can have on your investments.

Like a child starting to invest the little they earn.

It’s why I teach my children about the world of finance.

After all, to have better results, they need to start early.

Or, at least, as soon as they can.

Even if it’s just a little today…

Over time, that little will become a lot.

It will compound into something big…

Possibly beyond their wildest dreams.

I doubt 11-year-old Warren Buffett had ever imagined…

He would eventually become one of the world’s wealthiest investors.

(Or maybe, that was his plan all along).

As a parent, I firmly believe that having my children understand the concept of compounding…

Could be one of the greatest lessons I ever teach them.

I recommend you do the same with yours.