I once heard this joke.

“How do you make a million dollars?

Start with two million.”

It’s not quite as funny as it is true.

Often, the wealthier you are, the more likely you are to lose it.

Just look at the Forbes billionaires list every year.

While the names at the top generally stay the same…

(Buffett, Gates, Bezos, Bloomberg and Zuckerberg.)

It’s the others on the list that change year-on-year.

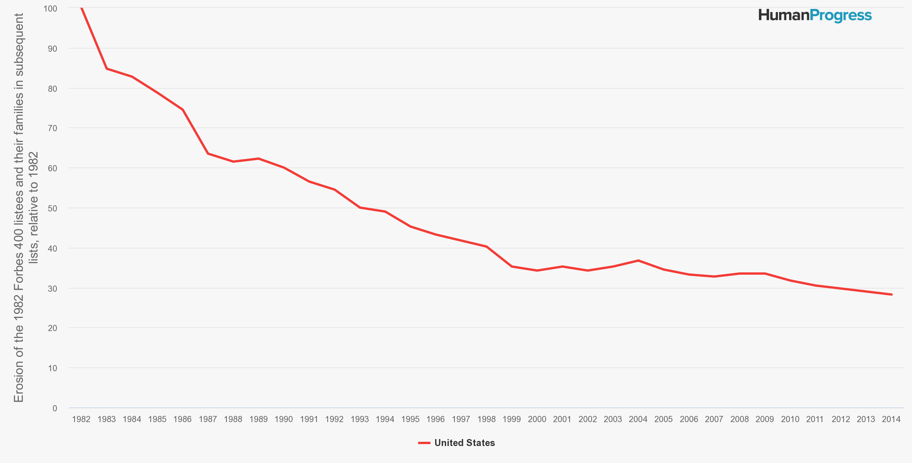

In fact, over 72% of those who made the list in 1982 lost their status by 2014.

The point is, making it onto the list is easier than staying there.

Other high-income earners have a similarly difficult time maintaining their wealth.

In 2020, 267 members fell off the Forbes list.

This means, each person lost at least one billion dollars in a single year.

That’s especially significant when you think about what one billion can get you:

- 4000 houses at $250,000 each

- 250 yachts that cost $4 million each

- 167 month-long holidays around the globe – for 80 people on a private jet

Johnny Depp’s no stranger to financial troubles too.

He made $650 million in his acting career.

Now, he speaks openly about his near bankruptcy.

(Most likely a result of his $2 million-a-month lifestyle)

Stories of financial loss seem to follow a similar pattern.

One that’s not unique to just the ultra-wealthy.

Numerous individuals run the risk of losing their fortunes due to bad spending habits and a lack of prudent financial planning.

So, what can we learn from their mistakes?

Don’t misinterpret income as wealth

There’s a difference between making a lot of money and being rich.

Those with high incomes are perhaps more likely to become wealthy.

But there’s greater temptation to spend excessively.

As Johnny Depp wisely put it:

“Wine is not an investment if you drink it as soon as you buy it.”

Your net-worth is the difference between what you own and what you owe.

It’s not your paycheque – regardless of how big it is.

The difference between what you earn and how much you spend is often a tug of war between what you want and what you need.

What lifestyle can you afford?

Some believe material things define wealth.

Expensive cars, monogrammed leather bags and limited-edition watches.

But truth is, anyone can look the part with just a swipe of a credit card.

(And mounting credit card bills paid off over many years)

This is not to say don’t enjoy life.

Merely exercise sound judgment and cautious spending.

And don’t let what you own, own you.

Your wealth won’t last forever

Making more money or getting a large lump sum is certainly exciting.

Suddenly you may have more money than you know what to do with.

The euphoria might drive your spending.

It’s probably why the National Endowment for Financial Education found 70% of lottery winners ended up bankrupt.

Seven-time lottery game grand-prize winner, Richard Lustig is one of the exceptions.

He’s kept most of his earnings and believes in the power of financial planning to secure his future.

He says:

“[People] go through [their winnings] like crazy. They think there’s no tomorrow. Well, there is a tomorrow and eventually it will run out.”

Know the difference between getting rich and staying rich

There are many ways to become wealthy.

But staying wealthy (the harder part) involves a different type of behaviour.

A different mindset.

Prudent spending habits.

And a commitment to save and build actual wealth.

Chat to us about creating a cash flow plan.

And the role it plays in sustaining your financial goals.

One that safeguards you against life’s twists and turns.