Why God would be fired as an investment manager (3 lessons from Him)

[Estimated reading time: 4 minutes - Read while pondering the meaning of life]

If you want to get rich, you probably dream of finding the ideal money manager – someone who can peer into the future and know which stocks will sizzle and which won’t.

The market guru we all yearn for is omniscient, infallible, nearly god-like.

But would you actually be happy with such a flawless creature?

Surprisingly, no.

In all probability, you’d find yourself frequently disappointed and disgruntled.

Despite what nearly everybody thinks, most of us would sabotage our results by firing even the most perfect adviser in the universe.

Wesley Gray, co-founder of Alpha Architect, a US-based asset management firm, made this point brilliantly in a recent study[1].

Gray, a former finance professor, looked at what would have happened in past decades if you’d been able to hire God himself as your investment manager.

Well, all right, not God exactly…

Instead, Gray looked at what would have happened if you’d been able to ride on the coattails of a hypothetical perfect investor over most of the past century.

This fictional money manager would know what was going to transpire in years ahead, so he would be able to perfectly select stocks that were set to roar.

Gray assumed that this God-surrogate would start work in 1927.

God would examine all major U.S. stocks, and infallibly pick out the handful of stocks that would go on to be the biggest winners over the next five years.

(He could do this, of course, because he – or more accurately, Gray – had all the historical numbers on hand, so he could easily look up the largest gainers over every five-year period.)

At the start of 1932, God would again look at all possible stocks, select a new portfolio of the next crop of big winners, and go on doing so every five years until 2016.

As you might expect, God’s results would be miraculous...

His portfolio would generate average returns of nearly 29% a year from 1927 to 2016.

His results would thrash the broad stock market, as represented by the S&P 500 index, which delivered average returns of only 9.87% a year over that same period.

So why would any client be upset with God’s stunning performance?

Because, despite his amazing long-term results, things would not always look so perfect on a day-to-day basis.

Even holding the best possible selection of stocks wouldn’t shield a client from the inevitable ups and downs of the market.

Between 1929 and 1932, God’s stock-market picks would lose nearly 76% of their value before staging a recovery.

During the 2008 financial crisis, his divinely inspired portfolio would decline more than 40% - before making an impressive comeback.

On more than 10 occasions during the 90 years of the study, God’s portfolio of top-performing stocks would suffer temporary setbacks of more than 20%.

What the numbers suggest, Gray says, is that God Himself would be fired many times over based on the short-term performance of His perfect portfolio.

Investors who want to achieve the best results should keep this study in mind.

It highlights three important lessons:

- It’s almost impossible to break the relationship between risk and return.

If you want to achieve high returns, accept the fact that you will, from time to time, experience nasty downturns. Don’t be tempted by a Bernie Madoff-like con artist or fast-talking salesman who promises big profits for little risk. It just doesn’t work that way in real life.

- You can’t judge an investment strategy, or a money manager, based on short-term results.

As Gray’s study shows, even someone making all the right choices in the market is bound to suffer temporary setbacks. Keep your focus on the long-term.

- Patience pays – and how.

Gray’s study shows that, historically, it takes investments close to a year – and sometimes considerably more – to begin to recover from a downturn. It takes even longer to go from the start of recovery to the next peak. But if your investment strategy is sound, the wait will be more than worth it.

Investors who want strong long-term results should keep all three points in mind.

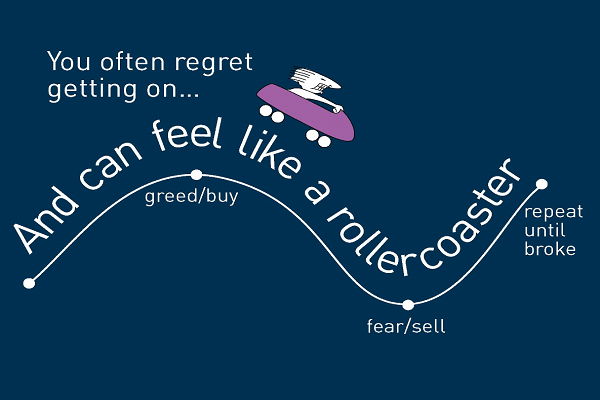

The surest route to investment hell is by impatiently chasing winners, and by assuming every temporary setback is a reason to switch strategies.

On the other hand, finding a good adviser, developing a well-thought-out plan, and then sticking with it for the long haul can yield heavenly results.