The Internet has made all of our lives easier.

In some ways, it’s made it harder.

With the vast expanse of information readily available…

It can feel impossible to decipher what’s right and wrong.

But investing is simple.

You just need to know these unchanging truths.

Let me start with an example.

Googling “is active or passive investing better for me” brings up a wad of contradicting information.

If you follow our blog, you’ll know we advocate a ‘passive’ or ‘systematic’ investment management approach.

It’s academically proven to get better results.

But there’s also a ton of information on the more traditional, speculative or ‘active way’ of investing.

As well as how to ‘do it yourself’.

If you were to crystallise the role that financial advice should have in so many people’s lives right now, it would probably be preventing them from making bad decisions.

For most normal people, a huge part of that is stopping needless indebtedness, managing debt responsibly when it occurs, and saving/investing well...

For most normal people, a huge part of that is stopping needless indebtedness, managing debt responsibly when it occurs, and saving/investing well...

Wouldn’t it be nice to have one list reminding you of investing’s (scientifically proven) best practices?

To reassure you when you’re feeling a little doubtful, anxious or fearful?

I looked for one and came up short.

So, I decided to create one.

I hope it provides clarity in a world of confusion and contradiction…

As well as confidence and reassurance that you are doing the best you can for your financial future.

At the end, you can also download this as a handy one-pager.

#1. You MUST have a financial plan.

So, you have a portfolio of investments?

You are 100% into stocks, or maybe 60% into stocks and 40% into bonds?

That’s fine.

But that’s not a plan.

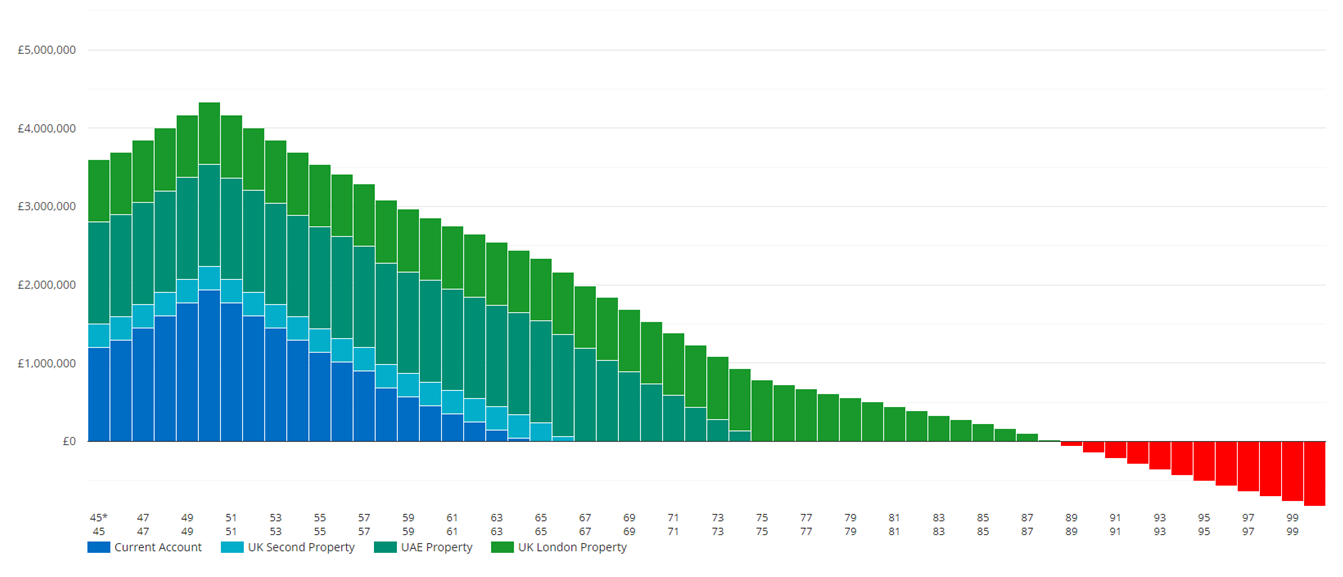

A plan is a clear roadmap of where you are and where you want to be (in numbers) and the systematic steps needed to get you there.

The plan evolves with you as you move through life.

So, updating it annually or bi-annually is as important.

One looks a bit like this:

#2. The stock market rewards the patient and punishes the rest.

Patience is the ability to accept or tolerate delay.

Admittedly, in other areas of my life, I’m not so patient.

But when it comes to investing, you have to be.

I’ve written many blogs on how ‘time in’ is more important than timing.

Data tells us over and over that the best results come from having a globally diversified portfolio, aligned with your risk appetite, and leaving it alone.

It’s boring.

It requires patience.

If you want an endorphin rush, try roulette.

Or bungee jumping.

Not investing.

#3. Rising prices (inflation) can be your best friend or worst enemy.

Many investors don’t account for inflation.

It’s a sad reality.

The value of 1 million (regardless of currency) today, will be far less 10, 20 or 30 years from now.

I once read a statistic that said millennials with 40 years to retirement, will see the value of 1 million equate to 306,000.

That’s more than a third of the value lost to inflation.

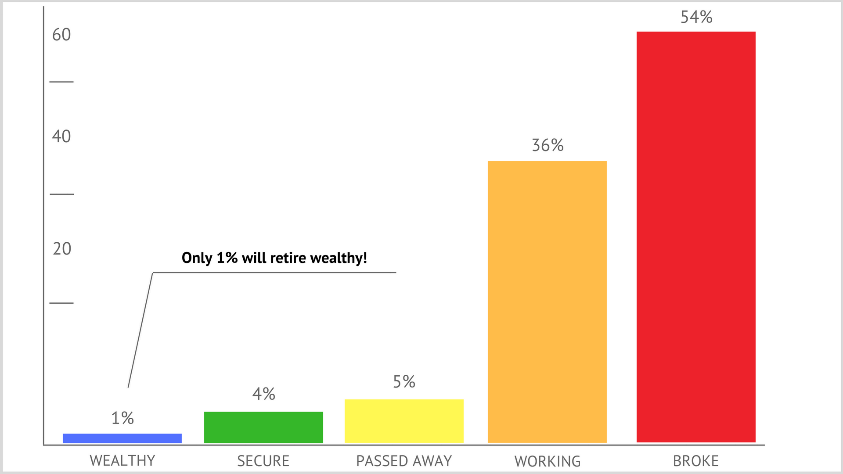

We’re always encouraging our clients to spend less and invest more.

It’s not easy.

If it was, more people would be retiring comfortably.

You owe it to yourself not to be part of the 99% who don’t.

#4. Long-term returns come from investing in the great companies (equities) of the world.

Capital markets are efficient.

Making it extremely difficult, and maybe impossible, for any investor to outperform them consistently.

Wouldn’t you rather harness the growth of the global economy, by investing in funds that target different dimensions of the market such as profitability, term, company size, etc…

And sit back and let the financial markets do their job?

Imagine the time and money you will save, the less stress you will feel.

Buy the haystack and stop looking for the needle.

#5. All savings need to be automatic or they won’t happen.

Pay yourself first.

That means routinely AND automatically putting money into your investments before spending it on anything else.

Automate your savings (at least 10% of your salary), to be immediately deducted from your salary as soon as it’s paid.

Consistent saving not only becomes a habit.

It also harnesses the power of compounding, making your money grow even further.

#6. The media does not have your financial futures in mind.

New funds or investment products are usually launched with much fanfare.

Suddenly the media becomes an ‘adviser’ encouraging you to ‘buy now’, feeding into our human instinct which is to follow the herd.

But they’re not advisers.

They’re paid by advertising companies and media outlets to push their biased messages as far and wide as possible.

You, with your individual goals, to retire comfortably or make sure your kids have the best education possible…

Are, sadly, not their priority.

#7. Disciplined behaviour will ensure your financial success.

Discipline is one of the hardest things.

Sticking to my 5-day-a-week gym routine or carb-free week-day meals is a mental, and physical, challenge.

I have to constantly remind myself of what I’m setting out to achieve, to motivate me to follow through.

I’m sure I’m not alone in this.

It’s the same for investing.

Some days it’s hard to ignore the noise – both externally and internally.

But you have to.

You owe it to your future self and your ideal future to stick to your plan, no matter what.

#8. There will always be negative news to report. Learn to ignore it.

Bad news sells.

It’s why, when markets crash for example, the media has a field day with headlines that play with investors’ emotions.

But what bearing will a crisis NOW have on your 30-year retirement plan?

If you stay the course – nothing at all.

I recently published a post on 30 years of investment excuses that the markets happily ignored.

Think elections, natural disasters, economic meltdowns.

It showed, all too clearly, that in spite of global events…

No matter how large or catastrophic…

The markets bounce back.

So regardless of how upsetting, frustrating or downright bizarre these events may be…

You need to leave your investments alone.

#9. Tax is likely to be your biggest expense, learn to control its impact.

Just a few days ago I read an article about the investigation of estates hit by inheritance tax in the UK…

A quarter of all estates liable for the tax.

Experts blame the complicated rules which lead to mistakes rather than outright fraud.

I’ve seen it myself.

We’ve had clients asking us to simplify their tax obligations for them as they have no idea where to begin.

Not to mention the increasing complexities that arise from being an expat and the taxes owed in one country vs the other.

It’s why we’ve created guides and blogs to help.

Finding ways to mitigate tax is completely legal – there are allowances many people are not even aware of.

Yet, it can save them hundreds of thousands of pounds.

#10. Never forget truth #1.

Your plan is your compass.

It will guide you in the right direction and keep you on track.

But for someone with a family, a multitude of goals and an estate; drilling down to that plan can be a difficult task on your own.

You’ll need someone with the experience and expertise who’s capable of helping someone like you.

Who can give you a blueprint of your financial comings and goings to assess your financial health…

Before helping you map out your financial journey.

A service like this doesn’t need to cost an arm and a leg.

And it doesn’t need to come with hidden clauses and confusing fine print either.

Want to know more?

We’d love to hear from you.