"Market data doesn't lie. So we've made a crucial decision. We're not going to try and win a few hands - we're going to own the casino" - Matt Hall

I love this quote by Matt Hall in his book, Odds On.

He’s comparing ‘traditional’, speculative investing with a ‘systematic’ or evidence-based approach.

Like a roulette wheel, global equity returns are random.

Winning big may occasionally happen.

But this is down to luck.

Here’s the proof.

Dimensional Fund Advisors explained in an article that global equity returns are remarkably random and almost impossible to predict successfully with any consistency.

It was such an impactful piece that I even shared it with my clients.

Here’s the essence of it.

Investment opportunities exist all around the globe

Across more than 40 countries, there are over 15,000 publicly traded companies.

If you listen to the news, however, some countries may seem like better places to invest than others based on how their economies and stock markets are doing at the time.

Fluctuations in performance from year to year only add to the complexity, providing little useful information about future returns.

Daunted by the prospect of sorting it out, some investors look to the place they know best — their home market.

There can be good reasons, such as tax benefits, for prioritising an investment close to home, but too much home bias could mean underweighting or missing out on part of the investment universe.

Australia, for example, represents 2% of the global equity market.

An Australian who aims to build a global equity portfolio may have cause for investing a greater amount at home.

However, this would come with the trade-off of reduced investment in other countries.

The same is true for a Japanese investor, whose home country represents 8% of the global equity market.

Even the US equity market — the world’s largest by far — is only about half of the global opportunity set.

As a Scotsman, I find it hard not to be fixated upon the UK FTSE.

Fortunately, no one needs to be an expert in every region to benefit from the opportunities those regions present.

Equity markets process information continuously, leveraging knowledge from millions of buyers and sellers each day as they set security prices.

Investors can trust market prices to provide an up-to-the-minute snapshot of global investment opportunities.

Because prices do such a good job incorporating information about securities in every market, they also offer the best prediction of future prospects.

No sensible story or compelling empirical research suggests investors can consistently outguess those prices and pick winning countries.

A globally diversified portfolio invested in the world’s greatest companies can help capture the returns of markets around the world and deliver more reliable outcomes over time.

Reading the checkerboard

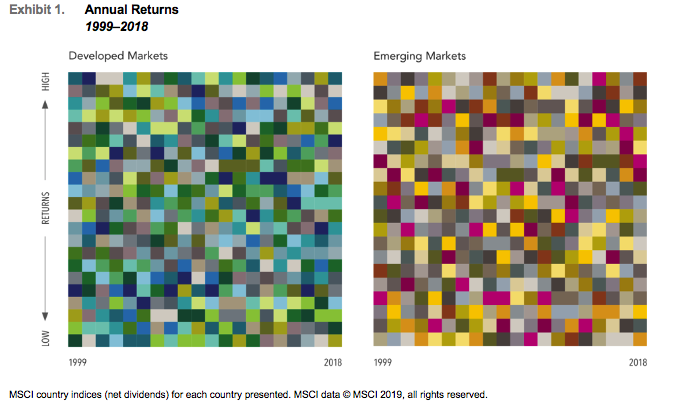

The tables below from 2019 illustrate 20 years of annual equity returns for developed and emerging markets.

Each colour represents a different country.

Each column is sorted top down, from the highest-performing country to the lowest.

Taken together, these tables powerfully demonstrate the randomness of global equity returns.

In either table, pick a colour in the first column and follow it through to the right.

Does any country seem to follow a pattern that gives clues about its future performance?

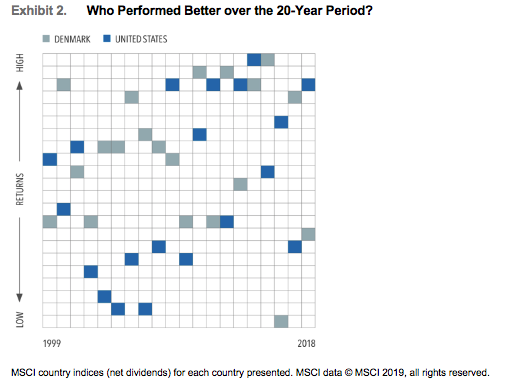

Consider the performance of the US and Denmark, shown below.

Is it immediately clear which country had the higher return over the past two decades?

Denmark, in fact, was the best performer among all developed markets, with an annualised return of 10.6%.

Surprisingly perhaps, Denmark had the best calendar year return only once, in 2015.

The US, despite some strong returns in the last several years, placed ninth overall with an annualised return of 6.3 %.

Bear in mind, Denmark represents less than 1% of the global market cap available to investors.

From first to worst

Denmark also provides an example of the unpredictability in short-term results.

After posting the highest developed market return in 2015, Denmark had the lowest return in 2016.

Countries have also moved in the opposite direction, from worst to first, in consecutive years.

In 2000, New Zealand had the lowest return among developed markets followed by the highest return in both 2001 and 2002.

In emerging markets, Hungary and Russia went from the bottom two performers in 2014 to the top two performers in 2015.

Going to extremes

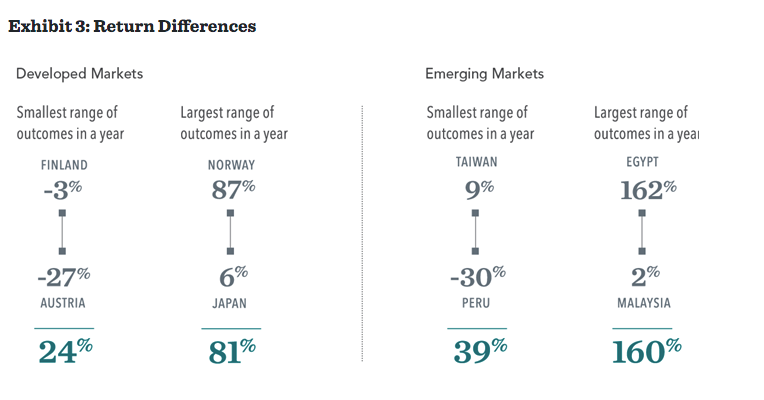

In a single year, the difference between the return of the highest-performing country and the lowest can be dramatic.

Among developed markets over the last 20 years, the difference between the best and worst performers has ranged from a low of 26% in 2018 to as much as 72% in 2009.

The differences in emerging markets are even more pronounced, ranging from 38% in 2013 to 179% in 2005.

In fact, the difference in emerging markets has exceeded 100% in several years.

These extreme differences in outcomes highlight the risk of trying to predict future returns by looking at the past.

And emphasise the importance of diversification across countries.

Now, the good news

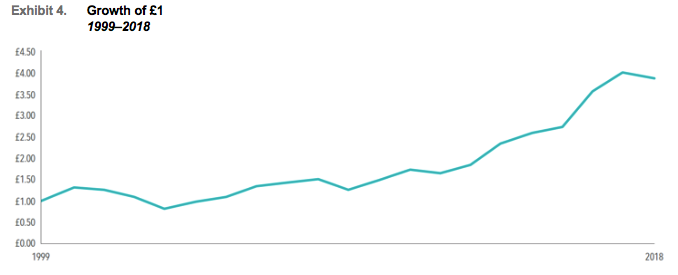

This evidence of the randomness in global equity returns, though, is not bad news for investors.

Rather than trying to guess which country is going to outperform when, investors committed to a well-structured portfolio are better positioned to capture the performance of the global markets, where and when it occurs.

Over the last 20 years, every pound invested in a globally diversified strategy, shown by the Dimensional Global Market Index, grew nearly fourfold.

A globally diversified approach can deliver more reliable outcomes over time with less volatility than investing in individual countries.

As Matt says in his book, it’s about not wasting a client’s time and money looking for needles in haystacks...

It’s about owning the haystack.

This can help high-net-worth investors, like yourself, to stay on track, through all kinds of markets, toward their long-term goals.

Looking at current data, we can see investment opportunities still exist all around the globe.

And with a globally diversified portfolio, the odds are stacked in your favour.