I read a psychology blog the other day describing three types of mistakes people make.

The first is when you purposely take on risk to achieve a specific goal.

The second is the result of weaknesses in our skill set, character or awareness.

And the third is revealed at significant moments when we revisit our priorities and perhaps realise we could have made better life choices...

These are often life-changing and help guide the decisions we make in the future.

Now let's look at how some of these mistakes happen with our finances...

I've worked in financial planning for over 15 years.

I've seen both sides of the wealth spectrum.

People who've made fantastic financial decisions and reaped the rewards for many happy years...

And those who unfortunately made costly mistakes.

I always believe in learning from others.

It helps put things into perspective.

After seeing how common many of these mistakes are, I decided it was time to put 'pen to paper' and share them with as many people as possible...

As far and wide as possible.

Here they are...

Mistake #1: Underestimating the length of your retirement

How long do you think you will live?

Research shows that most of us underestimate our life expectancy by between five and 10 years.

With major breakthroughs in modern medicine, it's likely we'll live even longer than that.

However, the problem is that if you are planning your investments over a 20 or 25 year time horizon, but actually need your money to last for 30 years or more...

You will probably run out of cash.

To avoid this, save as much as possible...

As soon as possible.

Don't de-risk too early and speak to an adviser if there's anything you're unsure of.

Any mistakes you make can be irreparable.

You certainly wouldn't want to lose a portion of your investment, regardless of how small...

Since it needs to work harder than ever before.

Mistake #2: Not aligning your investment strategy with your objectives

Most of us have a mix of short, mid and long-term financial goals.

Short-term goals will be things like going on a holiday, buying a new car or perhaps extending your home.

In most cases, investing in funds for these wouldn't make sense.

Using a good quality bank account with a decent rate of interest should suffice.

Mid-term goals will include paying for your children’s school fees, putting down a deposit on a house or starting your own business.

In these circumstances, you will have a longer period over which to invest.

You can take on more risk than a bank account.

Make sure you are taking enough risk to add value to your money over time...

(But be careful not to take on too much).

Your main long-term investment goal is likely to be your pension.

With time on your side, you can take on even more risk.

This will help boost your returns.

Failure to match your investment strategy with your objectives can lead to disappointment.

Or worse, major financial loss.

So make sure you understand your goals and strategy then invest accordingly.

Mistake #3: Misunderstanding risk

If you don’t fully understand the risk in your portfolio, you could be making a big investment mistake.

For example, you may be invested in top-performing equity funds.

Your enjoy lucrative returns when the markets are up.

But if you've invested all your capital in equities...

You'll feel the full brunt when the markets are down.

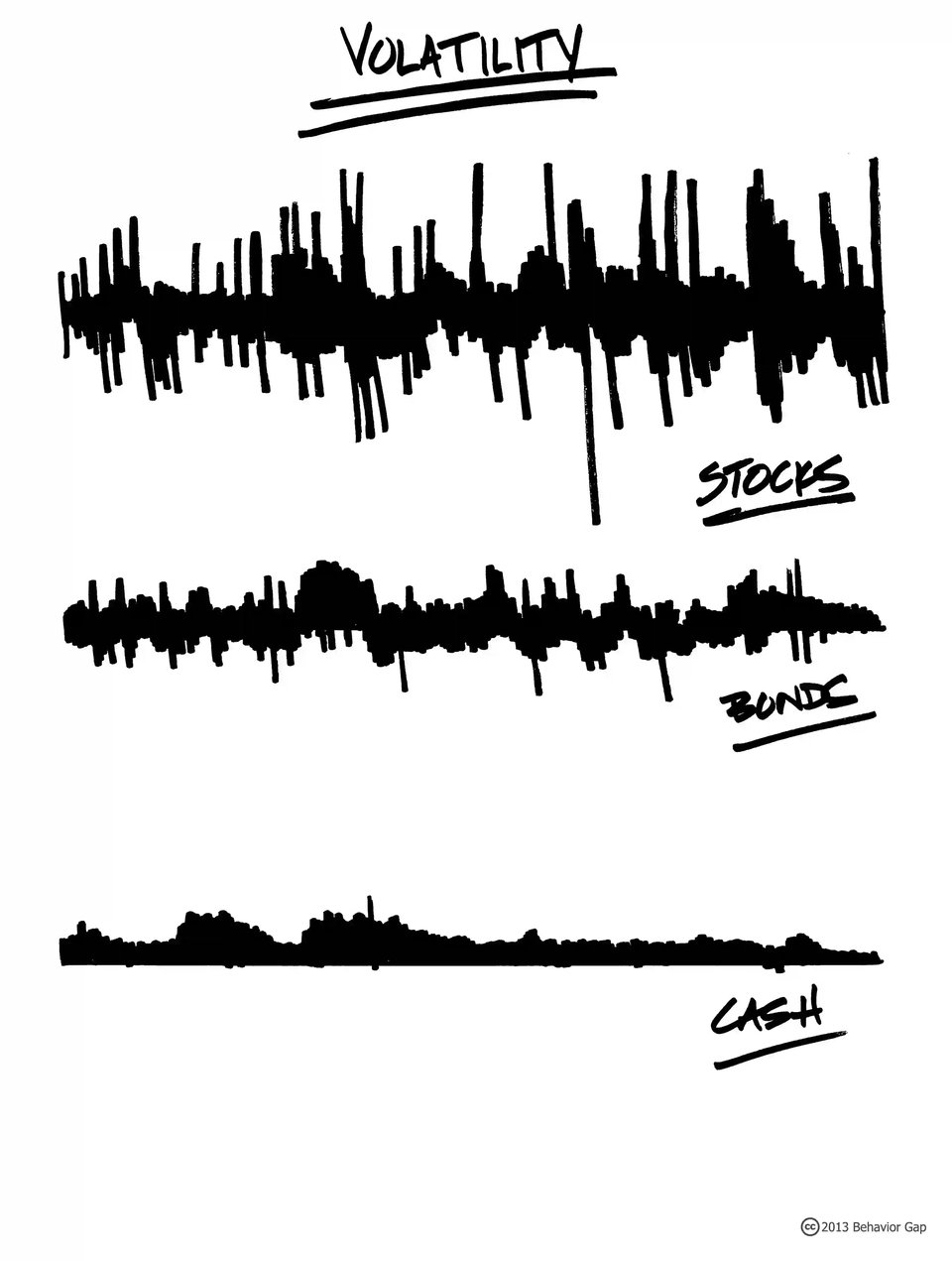

It's why the best, most sensible portfolios contain a mix of asset classes:

- Equities which do well in rising markets

- Bonds that are lower risk and cushion you during market falls

- Cash which is unaffected by market swings

(But remember; cash gets eroded by inflation).

Like everything else in life...

Balance is key.

Mistake #4: Allowing yourself to be sold to

Don’t be swayed by promises of “guaranteed high returns”.

These products are likely sold by pushy salespeople...

Yet are unsuitable and high risk.

They often fail miserably and wipe out investors' portfolios.

There is a reason these esoteric funds are small – and it isn’t because everyone else is missing a trick.

Stick to low-cost, globally diversified funds from regulated financial planners.

Don't be shy to ask for their credentials for your own peace of mind.

Mistake #5: Paying too much in fees

There are many fees and charges which can impact the performance of your investment portfolio.

These range from dealing fees, annual management charges, initial fees and performance fees to the charges you pay for advice, and more.

Know how much you are paying and what you're paying for.

It's the crucial first step to having the clarity and confidence needed to control one of your most important assets...

Your future.

Would you like to give us a try?

Financial planning is not easy.

There's more to it than simply investing in the stock market.

Things like taxes, estate planning, future healthcare costs, and more, all need to be accounted for.

It seems like a lot to do when you're working (possibly running your own business), taking care of your family and doing the hobbies and activities you love.

The good news is you don't need to do it on your own.

You can give us a call, on us, and see if we're the right fit for you.

After all, you want to be sure your future's in the right hands.