1 in 3 people born today will live to over 100.

Everyone is living longer.

We all want to know how long we’ll live but we’ll never really know.

All we can do is plan for all eventualities.

A life of ease and ‘retirement’ is everyone’s ultimate goal.

But with all the talk of longevity and retirement shortfalls, we need to plan our lives a little differently and be prepared for possibly living longer than we ever imagined.

It’s only natural to feel a little worried.

Here are 5 of our clients’ biggest questions on the topic.

Along with some answers.

If you have any of your own, let us know in the comments.

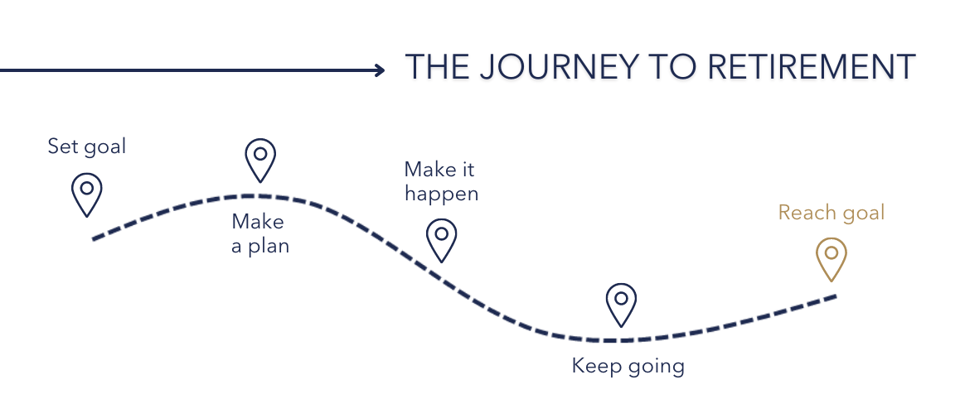

1. How can I achieve my dream retirement?

Planning for retirement (and retirement itself) comes in stages.

For high-net-worth investors like yourself, it's important understand your plans for the future.

A good place to start would be asking yourself questions like

1. When do you want to retire and where?

2. How much are your current investments and liabilities worth?

3. How do you plan to support your children and grandchildren in the future?

This should help you get a better idea of the ‘bigger picture’ to assess how much you'll need to reach those goals and whether your current investments can get you there.

However, if you're approaching retirement, you need to take a different route.

You need to establish how much is needed to cover the basic living costs to retire comfortably then assess how much is needed to enjoy your dream retirement.

From there, you'll need to structure your income.

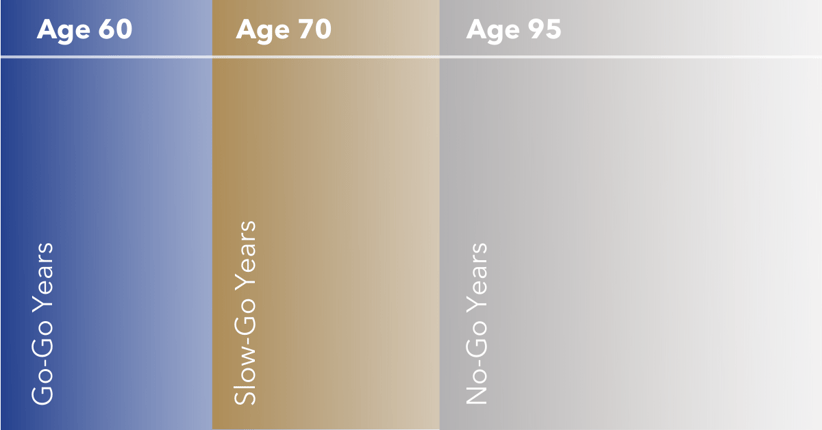

Income needs usually vary throughout retirement.

Generally, people spend more in the beginning while they’re still in good health and enjoying their days.

Below shows the 3 stages of retirement.

As you enter your late 70s, the ‘slow-go years’ spending tends to slow down and then spikes up again when healthcare costs increase.

No one wants to think about the downside of ageing but you have to account for it financially.

In addition, there are other considerations like tax-free allowances, ISAs and dividend allowance along with inheritance tax planning (for UK global citizens) at this point too.

These are usually dependent on personal circumstances and vary from country to country which is why you should seek expert advice on the matter - it's a complex area that's not easily managed alone.

2. I worry about retirement a lot, is this common?

Yes it is.

And there are certain worries we hear more often than others.

High-net-worth investors are often worried about making the wrong decision as they approach retirement.

There are so many pension options available that it can be quite daunting, not to mention confusing.

Decisions made closer to retirement can have long-term repercussions to your financial well-being as you won’t have time on your side to rectify any potential mistakes.

Many, even those with a very good understanding of finance and who’ve managed their own investments for many years are wary of making any decision without a second opinion from an expert.

Since we’re living longer than ever, running out of money in retirement has become a real concern.

However, as a senior executive and business owner, you're more than likely going to have a source of income.

You may remain on the board or venture into consulting and share your years of expertise with those climbing the corporate ladder.

This will help you maintain the standard of living you're used to - even if you now have more years ahead of you than you thought.

It's still a good idea to speak to a financial planner about conducting a cash flow analysis for you to ensure there won't be any surprises regarding your financial comings and goings in retirement

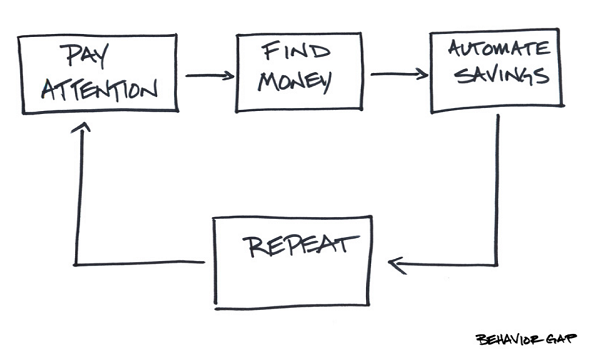

3. I’m not meeting my retirement goals, how can I make sure I do?

The majority of retirees aren’t achieving the level of income they need to live out their dream retirement.

The first step to overcome this is by having a second opinion review to confirm if your investments are properly set up and then build from there.

Quite often we see retirees keep a large portion of their money in cash which could have been invested.

This can provide a higher rate of return, if done prudently but, of course, presents additional risk.

Unlike cash, investments can fall and rise in value which means they could get back less than they invested.

But they can also get back so much more than they expected.

A pension transfer specialist will also take an in-depth look at their pensions to see if they’ve been drawn or are still invested.

A lot of the time, all you need is the right advice to establish a strategy that will better prepare you for retirement.

With the help of a professional financial adviser, you can have better peace of mind and feel more equipped to make financial decisions about your future.

Read our real-life case study on how we saved a retirement from almost going wrong.

4. Do people usually factor in long-term care when they come to you?

Most people do.

They’ve had experience with their own elderly parents and have an idea of what kind of care they’ll need, along with the costs involved.

Care can easily cost more than £40,000 per year so this needs to be part of any retirement strategy.

If you haven’t factored this in, we suggest you work this into your current retirement plan.

5. What advice can you give me to help me reach my dream retirement?

Be more involved in your retirement planning.

Make sure you understand exactly how your money is invested and why it’s invested that way.

It's important to understand your appetite for risk and level of involvement to create a strategy that works for you.

At the end of the day, only you know your journey from start to end.

All you need is someone who understands the same.

Until then, broaden your horizons by subscribing to AES Education.

It's a platform designed to help you believe in better and create positive change in your life starting today.