The first time I helped lottery winners was back in 2014.

They'd won £13m.

Their worries - gone.

But like many of the senior professionals we help all over the world...

They were missing one important thing.

In 2011, I remember reading about Colin and Chris Weir from Scotland.

They were Europe's biggest lottery winners at the time.

With their £161m win, they were catapulted into the Sunday Times Rich List above Beatle Ringo Starr and Sir Tom Jones.

Their dreams had come true.

I also knew, however, that 70% of lottery winners end up broke.

A third go on to declare bankruptcy.

And for many, money doesn't always equal a care-free life.

(Many famous faces have also taught us this).

A life-changing year

Back to our lottery winners, who were aged 52 and 57 at the time of their win.

A labourer and bank cashier, living in a modest three-bedroom terraced house...

Their joint income was £45,000.

Their net-worth now resembled many of the successful international professionals we help every day.

But by the time they sought financial advice, they had £8m left.

£5m spent...

On a dream home abroad, two new top of the range BMW’s...

Plus six more properties for family and friends.

Even though they were living their dream life overseas...

They were becoming worried, frustrated and anxious.

They didn't have a plan to manage their wealth.

Nothing lasts forever

Since The National Lottery started in 1994, over 6,000 millionaires have been created in the UK.

But several now have little or nothing to show for it.

When Pete Kyle won a £5.1m jackpot in 2005, he said it was "like a dream".

The retired Royal Artillery gunner vowed the money was going to change his family's life.

And for a while, it did.

He took his relatives on lavish holidays, bought cars and boats and swapped his home for a luxury five-bedroom mansion boasting a steam room, bar and pool.

But just three years later, Pete was reportedly broke and on benefits.

He had squandered an eye-watering £4,600 a day.

And was now in his retirement years.

While Pete was spending, the costs of goods and services was rising.

He didn't have a plan to last his lifetime.

No savings or investments.

What if I told you, that for people with 40 years until retirement, £10m is the amount they should be aiming to save?

That’s a lot of money, by anyone’s standards.

But inflation means £10m may just about cover a comfortable retirement.

£1m will have the same spending power as £306,000 today.

£10m will equal £3,060,000.

Over the course of that retirement – it will shrink again.

Our lottery winners now had £8m left.

They were heading for financial disaster in their early 70s because they had started to spend their winnings at an unsustainable rate.

Their general spending had spiralled out of control at £280,000 (after tax) per year, as well as one off expensive gifts.

Soon, they would have to start selling the houses they had bought for family and friends.

And if they kept up their spending and tried to match inflation for 30 years, then their new home overseas would need to be sold too.

Even lottery winners need a financial plan

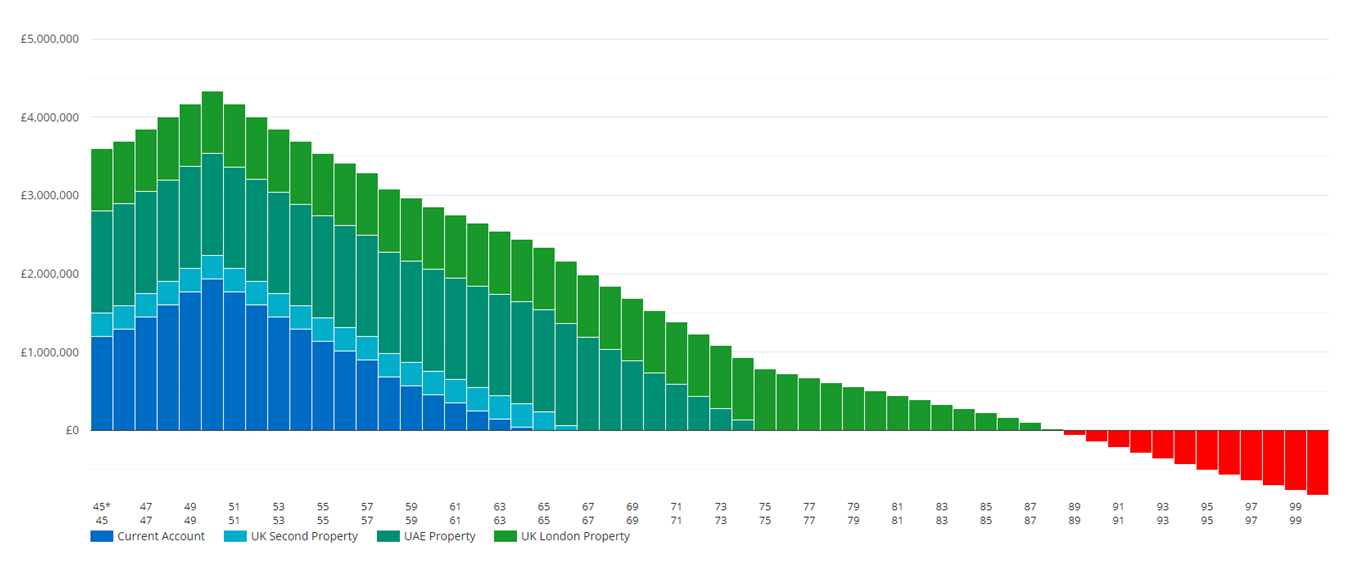

By carrying out lifetime cash flow modelling, we were able to illustrate the point at which they would actually run out of money.

A example cash flow plan looks like this:

This sobering realisation led to them to follow this three-point plan:

1. Get professional advice

Our clients' lives had changed forever.

The drudgery of things like bank accounts and wills needed to be sorted.

Not to mention estate planning and tax planning.

It was time to do the maths.

Put their life into numbers.

To partner with a fiduciary who was ethically bound to have their best interests at heart.

Not sell them products they didn't need or understand.

2. Plan now, spend later

Most wealthy people talk about their investments, not their spending.

Our lottery winners agreed to stop spending large lump sums and focus on the long term.

It was time to start thinking about the future.

Theirs and their loved ones.

They needed to put their retirement plans into action, while there was still time.

3. Invest systematically

The couple needed a globally diversified portfolio of low-cost investments in the world's best companies.

A clear and simple way to preserve and grow their wealth over the years to come.

Choosing this approach meant they would benefit from the growth of the entire market...

Avoiding trades that attempted to predict what’s ‘hot’.

(Needles in haystacks).

Once set up, it would be left alone.

Letting the markets work for them.

A lesson you can take from this case study

Investing for the future always makes more sense than spending in the now.

Build your wealth so you can get and keep the life you want.

Spend less than you earn and invest wisely.

Take financial advice while you're in the strongest position to do so.

Don't put it off and risk frittering away your opportunity.

If you feeling in any way confused, frustrated, annoyed or lacking a plan, it's time you got a second opinion.

Because there's never a better time to sort your financial position out than right now...