The stock market is volatile for the first time this year. Here's what to do

For the first time this year, we're seeing some volatility.

The S&P 500 saw its largest weekly loss in 6 months.

The MSCI World Index is down.

Even Nvidia saw its second weekly close below the 20-day moving average.

But this is NORMAL.

In fact, it's healthy...

In the early days of March, we saw all-time highs in US markets, Gold and even Bitcoin.

It reminded me of 2021 when it seemed like everything was hitting an all-time high.

Pre-March this year, the stock market had four straight months of gains.

But, things that go up, must eventually come down.

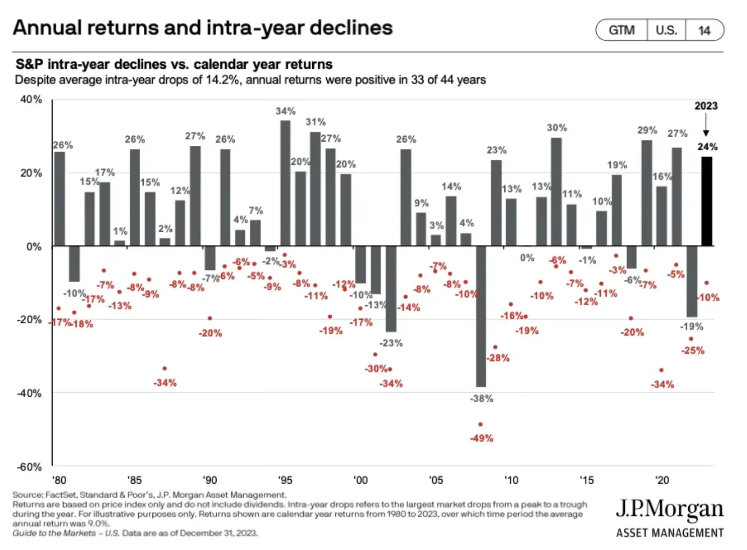

Take a look at the below chart, which really tells the story of investing.

It shows just how much volatility the S&P 500 has experienced over the past 44 years.

Each year’s annual return for the S&P 500 is in grey, and its intra-year max drawdown (i.e., the biggest sell-off from its high of the year) in red.

The average intra-year drop is 14.2%.

Despite that, the annual returns have been positive 33 of the last 44 years.

That's 75% of the time.

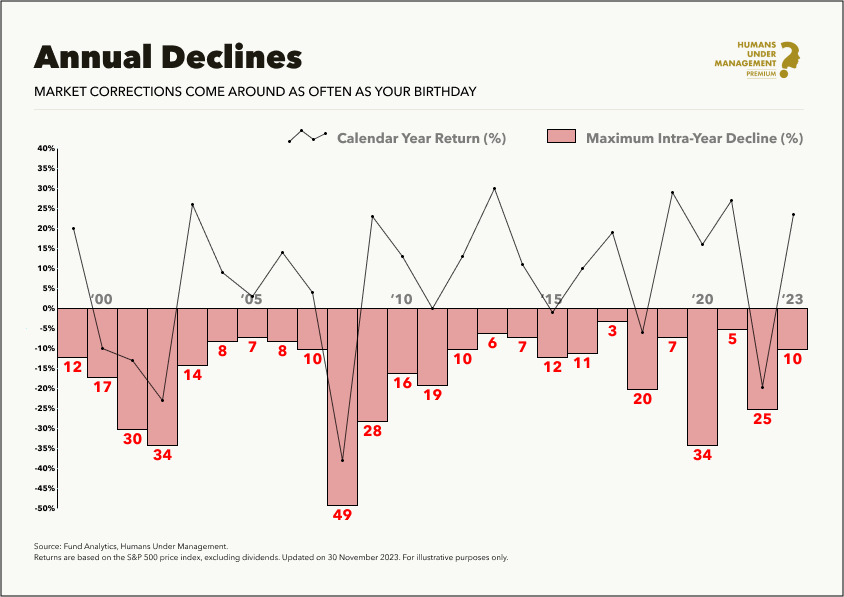

Here's a slightly simpler version, starting from 1999:

It shows the calendar year return (the line) and the maximum intra-year decline (the red bars) for every year up to 2023.

Take a moment to look how many years have both big declines AND positive returns.

Volatility such as this is the price of admission for life-changing returns.

The difference between pullbacks, corrections, bear markets and crashes

There are different definitions when the stock market experiences selloffs:

-5% = Pullback

-10% = Correction

-20% = Bear Market

-30% = Market Crash

The simple fact is, with risk, comes volatility.

As a long-term investor in the great companies of the world, you should prepare for, and expect, at least 3 yearly pullbacks and a correction at some point.

It happens.

It’s normal.

It's okay.

Try not to be surprised.

If you planned prudently - using capital market assumptions based on academic evidence - you can embrace optimism.

These events occur far more frequently than most investors believe (as often as your birthday, as the chart above shows).

A selloff doesn’t mean a market crash.

A pullback doesn't mean a bear market.

We can't expect things to go up all the time.

Investing and the stock market is never a straight line.

But it does fluctuate around a generally upward trend.

We call this “volatility”.

Unfortunately, we cannot consistently predict ahead of time when these fluctuations will occur or when they will reverse. To be a successful long-term investor is to accept the above with humility.

What you should do

When a threat appears, it’s natural to want to run away.

However, a market decline is a (mostly) harmless phenomenon that can only harm you if you react the wrong way.

Market declines will happen consistently over the course of your life, and your mindset when they occur is a choice that will determine your financial future.

We recommend that you confront them with confidence rather than fear, mindful of the opportunities they provide.

Importantly, you have the luxury of being a long-term player in a system where everyone’s playing a different game.

Contrary to the day-trader, what happens in the next 30 days is unimportant to your 30-year plans.

If you’re in it for the long run, the odds are stacked in your favour.

You’re guaranteed to win.

We know that stock markets provide positive returns about three in every four years.

The negative year earns you the other three.

It’s the price of admission for profiting from the collective ingenuity of the hundreds of companies working for you while you sleep.

We encourage you to see the temporary declines are the reason for the stock market’s permanent returns.

You can’t have one without the other.

The correct behaviours have been modelled for us by many great investors:

- Have a long-term perspective. This reminds you what it is you’re trying to achieve on your investing journey and why it is that you’re trying to build wealth. Understand history, and you'll become a rational optimist over time.

- Accept short-term disappointment. Setbacks are inevitable, and in investment markets, this shows up as market volatility – times during which asset values decrease in price.

- Be patient. Great results come to those willing to wait to see the fruits of their labour.

Time heals

The stock market is a device for transferring money from the impatient to the patient.

As you exercise the patience you’ll need to repeat many times in the future, be encouraged that you are busy earning future returns.

If you’re still saving, declines are your best friend, allowing you to buy more units of shares at knockdown prices.

Success in life requires the practice of rationality under uncertainty, and to be successful long-term investors, we must decide to act on a plan rather than react to market movements.

While we don’t know where the market will be in 6 months, we’re pretty confident where it will be in 10 years: much higher.

Time is the enemy of market declines, and we’ve got plenty of it.

So much of investing is about holding two thoughts in our heads at once.

One is to believe "most years will be good"...

While at the same time, "almost every year will be bad at SOME POINT".

Remember, the stock market usually goes up.

It won’t always go up.

Keep the data in mind.

Stay grounded.

Be mentally prepared for pullbacks.

It's part of the deal when you invest in the great companies of the world.

Image credit: Humans Under Management