What are the signs that you are overthinking and risking your investment? (PLUS 7 tips to stop those negative thoughts)

‘Why did I say that?’

‘Why did I do that?’

Are you an overthinker?

You’re not alone.

And there’s help.

Contrary to problem-solving and thinking about a solution…

Overthinkers dwell on the problem.

Like fixating on a bad investment decision made in the past.

Or not saving enough for retirement.

Overthinking is unproductive.

Instead of planning ahead or developing new insights to learn from…

Overthinkers are paralysed by their problems…

Afraid to move forward.

They tend to be bad sleepers, unable to shut their brains off…

Or stop reliving moments of regret.

They also look for hidden meanings in what people say or do…

And worry about things they have no control over.

Sound familiar?

Perhaps these 7 tips can help:

1. Trust your strategy

Overthinking often stems from doubt. A lack of trust.

Make sure you’re happy with your investment strategy.

That the risk you take on, is risk you’re comfortable with.

And have faith in your financial planner.

If not, reassess and review it until you are.

Even if that means getting a second opinion elsewhere.

2. Don’t think about what could go wrong, but what can go right

We tend to focus on what might happen, what could go wrong…

What if the market crashes?

What if we’re headed for a recession?

Next time you’re heading into negative-thought territory – stop.

Visualise, instead, of things that can go right.

Remember your long-term goals and imagine them coming true.

3. Stop aiming for perfection

Having ambitious goals is great.

But aiming for perfection is unrealistic. It blinds you from seeing progress.

When it comes to investing, there is no one single optimal portfolio.

It’s far more important to have one you understand, and you’ll stick with…

Through the good and bad.

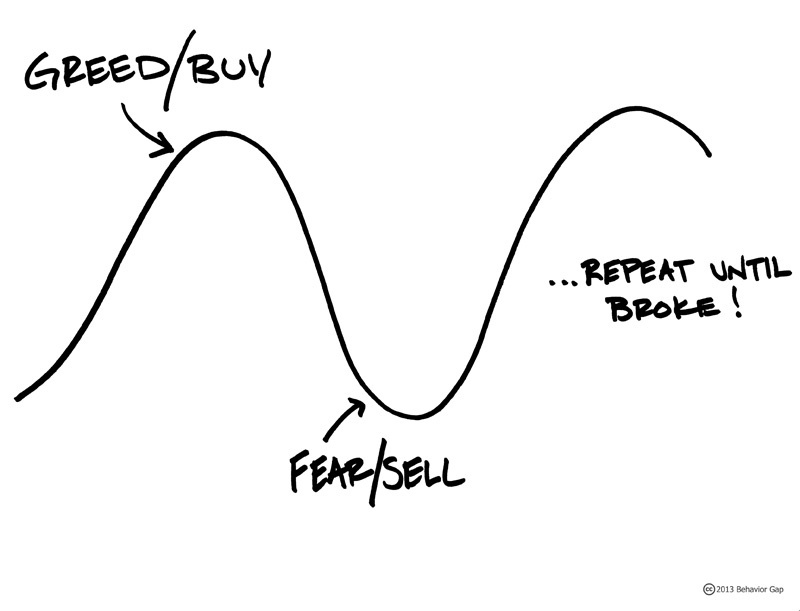

4. Don’t let fear cripple you

Whether you’ve failed in the past or are too scared to try…

Remember, just because things didn’t work out for you or someone else…

Doesn’t mean the same will happen again.

As an investor, you need to be able to see past your emotions…

To remain calm and rational when making any decisions.

5. Realise you can’t predict the future

(And no one else can either).

All we have is now. The decisions we make today.

Stop focussing on what could happen…

Find a financial plan that works for you, then leave it alone.

Enjoy today and trust you’ve made the right decisions for your future.

6. Put things into perspective

I saw a quote that sums this up:

‘Breathe. It’s only a bad day, not a bad life.’

It’s easy to blow things out of proportion.

A bad year in the markets doesn’t mean a bad investment management strategy.

Take 2018 or even 2008 for that matter.

Many suffered losses.

But in the case of 2008 – those who stuck it out, reaped far better rewards.

7. Find someone who listens

Sometimes you need someone to tell you:

‘You’re overthinking it’…

To help weigh the pros and cons when you can’t.

Someone who remains unbiased and trustworthy. It can be a friend, partner or financial planner.

If you’re looking for the latter – you’ve come to the right place.