[Estimated time to read: 9 minutes]

At year-end many of us think ahead and try and make some resolutions for the next 12 months.

Apart from health promises, financial resolves are top of most people’s list of New Year resolutions.

If you’re thinking about getting your finances in better shape in 2017, do you need a financial adviser to help you?

You may be surprised that my own opinion is that many people don’t actually need a fulltime financial adviser.

Depending on your personal circumstances, you may be wasting your time and money employing one.

Five things you can expect from this article…

- In this post I will help you decide whether you can financially benefit from an adviser’s help or not.

- I will also give you a link to a service that can financially quantify whether advice will save, make or just cost you money.

- If you would financially benefit from speaking to an adviser, I include a checklist so you can choose a professional advice giver, rather than just a salesperson.

- If it’s clear that you don’t need advice, I also give you some ideas about where you can find free information or low-cost help, so you can manage your money on a do-it-yourself basis.

- Finally in this article, I give you three tips to help keep an otherwise DIY approach on target.

#1 – Do you need a financial adviser?

To determine whether you would benefit from financial advice there are three questions you can ask yourself.

First…

How complicated (or otherwise) are your personal financial circumstances?

As a very simple rule of thumb…the less complicated, the less likely you are to need and indeed benefit from a dedicated financial adviser.

Next, ask yourself this…

How complicated are your long-term financial ambitions – are you on track to achieve them?

Generally, the more complicated or expensive your goals and the further you are away from achieving them, the more likely you are to potentially benefit from some advice.

This can be best illustrated with this example…

If you’re saving to buy a house and you’re already investing regularly, you’re unlikely to need advice.

At the other end of the complexity scale, if you’re looking at generational wealth transfers and estate planning, chances are you need and will literally financially benefit from advice.

Finally, being brutally honest in your answer, ask yourself this…

Do you have the time, the interest and most critically, the calm temperament and discipline to do it entirely alone?

I’m very confident that you have the ability to do-it-yourself, create, manage and rebalance an investment portfolio, and make a successful job of it.

Why am I so confident?

Because you clearly believe in investing in your own further financial education on an on-going basis, as evidenced by your subscription to receive expert insight from our blog.

However, that doesn’t necessarily mean you have the time.

And far, far more critically, that doesn’t necessarily mean you won’t ever suffer from the behavioural biases that scupper most people’s DIY portfolios.

The most common behavioural biases are over-confidence and fear – they lead to people herding, (literally following the crowd), and buying high and selling low, rinsing and repeating all the way to personal financial crisis.

I don’t want you to do that! But that still doesn’t necessarily mean you have to pay for expensive advice…

What do your answers reveal?

- If you have over £250,000 in investable assets, or if you have complicated or challenging circumstances you may monetarily benefit from financial advice.

- If you lack time, passion for investing, or even the restraint needed to avoid being swayed by the market ‘noise’ that destabilises most investors, you may benefit from advice – perhaps occasionally, just to keep you on track.

- But if you’re like the majority of us and your situation is relatively straightforward, or if you’re very confident about your investment decisions, you may simply benefit from a robo-investment platform, or a straightforward passive investment portfolio, and actually get limited quantifiable value from a financial adviser.

#2 – A service that will determine if financial advice will make, save or just cost you money

We literally don’t have the human resources to help and advise the whole world!

That’s the reason we publish our blog and the books and guides in our Knowledge Library.

We want to give as many educational tools as we can to help as many people as possible to manage their own money successfully, and make sage financial decisions to secure their own fiscal future.

We also offer a review service that literally works out whether you would financially benefit from financial advice – or not.

The review analyses your circumstances and benchmarks your current savings, investments or pension portfolios; and if we can add literal financial value we demonstrate exactly how.

Likewise, when we can’t, we say so!

You can take our information away, and implement any suggestions for enhancing your portfolio yourself, or you can choose us to help you.

#3 – Professional services command professional fees

As a Corporate Chartered Financial Planning consultancy, we operate a fee-based model for financial advice and investment management services.

It’s the model we believe anyone seeking professional services, (from fiscal to legal to medical for example), is used to.

Therefore, if you decide you could financially benefit from our advice, we will gladly help you – and we will do so for a transparent fee, agreed with you up front.

Our fees are detailed in plain English here.

And you certainly don’t have to choose to work with us – but it’s important to know that any professional financial advisory or investment management service is always going to be fee charging.

How to choose your adviser carefully

![]()

With that in mind, here’s everything you need to know to choose an adviser who has your best interests (rather than their own) at heart…

Firstly, let me reiterate, do not expect to get given any financial advice for free!

Those who call themselves advisers and who offer their services for free are actually salespeople, and the distinction is an important one.

Advisers offer a professional service for a transparent fee.

Salespeople give their opinion for nothing, and profit instead through opaque commissions and fee structures on the products they sell you – usually without you even realising it.

Here is a free step-by-step checklist for choosing a professional adviser – if you follow it, it will lead you to shortlist to choose from.

#4 - Now it’s easier than ever to do it yourself

We’re not alone in giving away financial resources and education material.

I’m sure you’ll agree that any fiduciary or chartered financial professional demonstrates the fact they have their clients’ interests at heart by nature of their professional qualifications and accreditation.

Now look around at the best financial educators out there – you’ll see that many of those who have the best skills, the highest level qualifications and who are held in high esteem by their peers or clients are often the ones also giving away the benefit of their own insight for free.

These people care about helping their clients or peers with money, and they take the time to gain the qualifications and accreditation needed to demonstrate their trustworthiness.

Because they literally care about helping as many people as possible, they go on to share a lot of their great wisdom for free!

Thanks to the wonders of the Internet and social media you can now access a wealth of professional expertise for nothing – and get guided support as you build your own investment portfolio.

Valuable resources and educators include:

- Our own Stuart Ritchie

- Millionaire teacher and best-selling author on Amazon Andrew Hallam

- Robin Powell, The Evidence Based Investor

- Experts for Expats

- Carl Richards, Behaviour Gap

- Ben Carlson, A Wealth of Common Sense

- Monevator

All these people have so much to teach us – and because they are so passionate about their area of financial expertise and helping as many people as possible, the best thing is you can benefit from their wisdom and insight for absolutely nothing in most cases.

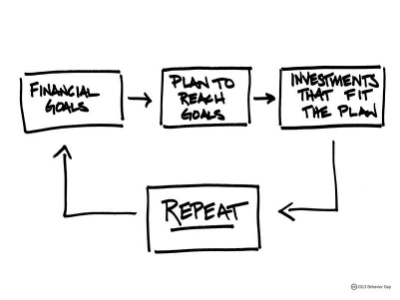

#5 – How to do it yourself and stay on track

If, having had a review of your portfolio, it’s evident that financial advice or investment management services won’t save or make you any money, it may make the most sense for you to do it yourself when it comes to managing your savings and investments.

Hopefully you will find inspiration from the above resources, and you can refer to them for guidance when you need; and here are three more suggestions that will help you stay on track to meet your financial goals when taking a DIY approach to investing:

A. Consider using a robo-investment platform

These function in a similar way to a bank account, in that you put money in and take it out when you need it, but for as long as it’s in the account it grows because it’s invested according to your own risk profile.

B. Choose an indexing approach

An alternative way to ensure you remain on track is to choose an indexing approach, where you select one or more passive investment fund that tracks a market.

This is likely to be a low cost way to spread risk and ensure you’re not having to listen to market noise and worry about stock picking.

There are plenty out there to choose from. Just make sure you keep your costs and complexity level as low as possible for the best possible potential outcome.

C. Get advice only when you need it

Finally, no matter what approach you favour, you can opt to have ad hoc financial advice or investment management support that gives you advice only when you need it.

You only pay for advice when you need it, and the adviser you choose can answer specific questions you may have as they arise. This is a very cost effective way for you to access and use an adviser’s professional services and expertise.

Opt for a fee-based Chartered adviser, agree costs up front, and then use the time you pay for wisely to ask all the questions you have to help you carry on managing your own investments.

Call us any time – we won’t cold call you…

We never cold call or make unsolicited approaches.

But we hope it goes without saying that we’re here for you if you have any financially related questions or concerns, requirements or problems.

Talk to us – we’ll always do everything we can to help.

And please do make full use of all our free resources – download them, print them out, share them, use them.

We want you to have all the support you need to make the best decisions possible for your healthy wealthy future.