In case you missed it.

Read part 1 of this blog to understand the first 4 key factors that make a planner 'worth it' or not.

I cover the next 3 factors in this blog.

And surprisingly, they're all about YOU.

To summarise, the last blog listed these as key factors in making financial planning advice worthwhile:

- The type of adviser

- The type and level of fees

- The breadth of advice on offer

- The adviser’s skill level

Now, let’s unpack the last three.

5. The investor’s skill level

Here’s an interesting thought…

Without your planner, how well would you do?

It doesn’t just come down to how knowledgeable you are on investments/financial planning but your personality type as well.

If you don’t have the knowledge, a planner perhaps has more room to add value.

On the other hand, if you are highly financial planning-savvy, hiring a planner may provide less of a benefit.

But be sure to keep a couple of things in mind when making a self-assessment.

First, it’s human nature to overrate our attributes.

Some of us overrate our financial acumen as well.

In other words, it’s possible you’re not as good at managing your wealth as you think you are.

With further self-reflection, you may realise have blind spots, for example in tax planning.

If that describes you, it might make sense to seek financial advice from a planner who specialises in your weak spot.

New York City-based wealth manager Nick Maggiulli wrote a piece called: Easy in theory, difficult in practice.

Nick compares investing to dieting, exercise and meditation.

All of those things, he says, fall into the category of “simple but difficult”.

Meditation isn’t something I’ve really tried, but I know from personal experience that the other two definitely qualify as difficult.

The rules of successful investing are remarkably simple — keep your costs low, diversify and wait for a very long time.

But the waiting part, in practice, is actually very difficult.

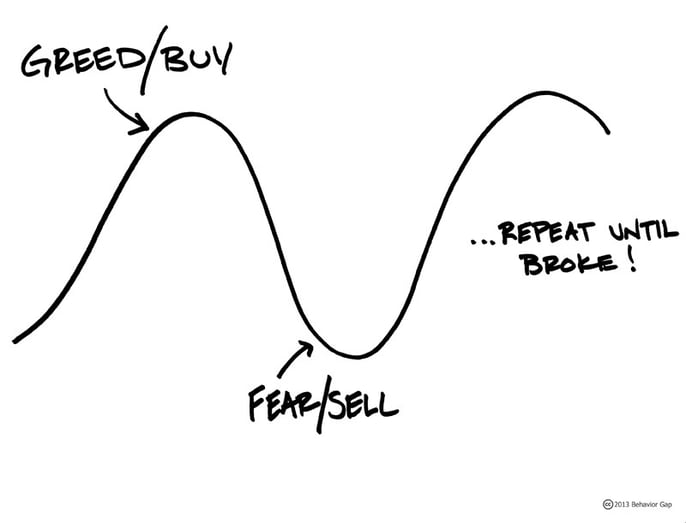

Investors are constantly surrounded by noise.

There’s always someone saying you should be doing something like buying this or selling that — when in fact the best of course of action is almost invariably inaction.

Most of us (men especially) have an in-built bias towards action.

If we’re honest, we’re all prone to fear and greed as well.

For example, when we see a colleague making a fortune on Bitcoin, buy-to-let property or global stock markets freefalling, we naturally want to act - even though the rational response, is to do precisely nothing.

“So what’s the solution?”, asks Nick.

“Get a good financial adviser. It may seem silly to you, as it once seemed to me. You’re smart. You may even know the math better than most of them, so what could they offer you? They offer a behavioural crutch to save you from yourself. They provide a path forward when the future could not seem less clear. That’s what you’re paying for.”

Yes, investing well can be simple.

But it certainly isn’t easy and surprisingly for many.

I personally value an independent, unemotional opinion I can trust.

So does the Nobel Laureate for Economics as he explains here:

There can be a disconnect between knowledge and action.

High-net-worth investors who know better still make poor decisions about their own money...

Whether it’s planning errors or making emotional investment decisions.

If you’ve made many financial decisions you later regretted…

You may benefit from hiring a financial planner who will help you make better choices for your future.

Although investors are predominantly motivated by maximising their own returns…

Many professional planners say they add more value as behavioural coaches compared to financial guidance.

6. Life stages

Life stage is an important consideration when deciding whether hiring a financial adviser can add value for you or not.

Proper financial advice can be incredibly valuable early in life.

It ensures your plan gets off on a solid footing.

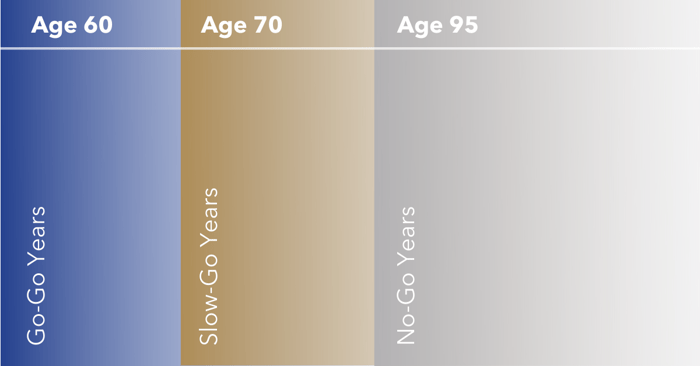

But it's arguably far more important for older adults and those with dependents.

When I had children, my own life priorities changed along with my investment and future plans.

And the complexity around planning will continue to evolve with health, property, retirement and estate planning considerations.

Retirement portfolio planning is inherently more complicated than portfolio planning during our accumulation years.

In addition, cognitive decline is a risk factor as we age.

Mistakes can be far costlier than good, professional advice.

Here's where having a second set of eyes looking at your portfolio can give you financial peace of mind.

7. Specific reasons

The last question to ask yourself is…

Do you really want to invest the time and effort in managing your own finances?

For a planner to have Chartered status, they must have at least 5 years or 10,000 hours of professional experience.

A commercial airline pilot needs 250 hours for their license to take you on a short trip.

Not many people choose to fly themselves on holiday and arguably your life journey is a lot more important.

With enough time and experience, you too could probably write a perfectly good financial plan, put together an investment portfolio, re-balance it, mitigate tax and work out for yourself how much money you need to retire with...

But aren’t there other things you’d rather be doing instead?

According to Canadian neuropsychologist and executive coach, Dr. Moira Somers, the top ten reasons people seek financial advice (instead of trying to manage their own finances) are to:

- Reduce complexity

- Take action

- Save time

- Offload unpleasantness

- Make someone else happy (children or spouse)

- Increase confidence

- Help make better trade-offs

- Receive encouragement

- Have someone to blame

- Feel safer

What’s interesting about the list is the absence of items you’d expect.

There’s no mention of picking the best investments or producing market-beating returns.

In my experience, the majority of our professional clients want help making more informed and effective financial and life decisions that enable them to feel relieved, confident, empowered and good about their wealth and future.

They want to get away from frustration, confusion, complexity and closer to clarity, confidence and control.

Just to end off…

I’m often asked whether people actually need a financial planner.

Just like other professionals such as lawyers, doctors, accountants, and personal trainers, the simple answer, strictly speaking, is no.

But this comes with an important caveat: you may well come to regret it if you don’t.

Everyone has different circumstances and I tend to agree with Robin Powell, who says:

“Not everyone needs a financial planner – at least not all of the time – but there is no one who wouldn’t benefit from good financial advice.”

For me, the combination of evidence-based investing and proper financial planning including cash-flow modelling, is the gold standard.

Fiduciary firms tend to pick their wealthy clients (and employees) carefully.

They only offer their services to those who are willing and able to pay for the value they offer.

This means you can normally expect to be told if you’re not the right fit for them.

And that’s fine because they will likely point you in the right direction to get the help that is right for you.

Because when you find the right advice for you and your life goals…

You’re giving yourself the best possible chance of achieving them.