Are you more Patrick Swayze in Point Break or Christopher Columbus? (Because this says a lot about the type of investor you are).

I love an analogy.

Especially one which relates to finance.

I recently read a great one which explains volatility.

If that’s a part of investing you find discomforting…

Perhaps this will help.

(Hat tip to Ric Edelman, head of America’s largest independent investment management adviser).

Ric asks his readers to name the closing number of the Dow Jones Industrial Average on April 6 of 2017.

In fact, to make it easier, he asks for the closing number of any date in April 2017.

Who can do that?

Certainly not me, or Ric Edelman.

What’s more, who even cares?

After all, it makes no difference whatsoever.

The point Ric makes, is that if you are a long-term investor…

As we advise our clients to be…

There’s no need to be concerned with what the Dow (or any Index) is doing on any particular day.

When volatility returns to the stock market, some people call us expressing worry — and a few show outright fear.

Perhaps not surprising, since the Dow can drop by record levels one day, and almost recover the next.

Bouncing between gains and losses.

So why shouldn’t you worry?

Let’s use Ric’s analogy.

Surfers love the thrill of riding the waves.

It’s exciting…

But they often wipe out.

Sailors, by contrast, know that waves don’t affect the tides.

The ocean ebbs and flows on a regular schedule.

Tides are predictable, measurable and manageable.

Which are you?

Consider market timing.

If this matters to you (miss it and you lose)…

You’re a surfer.

You want to catch the next big wave.

Feel that adrenaline.

Beat the awesome power of the ocean.

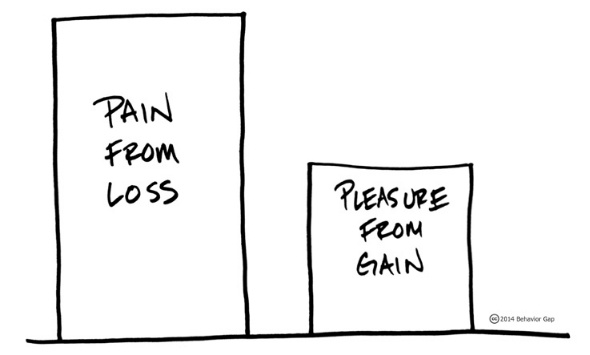

But your last win can be wiped out by the next loss.

You must pay constant attention, and even that won’t ensure your success.

You might have enjoyed lots of action, but actually travelled nowhere.

(Since surfers always end up exactly where they started: on the very same shore.)

If you prefer to take advantage of predictability (of the tides, say)…

And use it to achieve your goal…

(Getting from this shore to the one that is far, far away),

You're a sailor.

Content with ignoring the waves.

You know that waves are part of your journey, and you understand that such storms must be tolerated.

Jumping off the ship doesn’t help you reach your goal.

You simply miss out on the inevitable calmer seas to come.

So, are you a long-term investor?

If you are, you aren’t tempted by chasing the next big thing, or worrying about short-term market swings…

(Which apart from being useless, distract us from what we save and invest for in the first place).

If you are, you’ll be concerned with achieving major life goals such as college for your kids and retirement for yourself.

You’ll ignore the message spouted by the traditional financial services industry and the financial media…

(That you have to beat the market to be a successful investor and the only way to do this is by picking the right investments, at the right time).

You’ll embrace the evidence and skip the distractions.

Tune out the noise.

Live your life!

We’ve been called the lifeboat of the financial services industry.

It’s a nice fit for this blog.

If the waves of volatility are affecting your strategy, we’d love to talk.