“Our retirement withdrawal plan beats the 4% rule,” say these clever retirees

Roberto Ramirez and Gwen Stark sipped wine while they dipped their toes in the Caribbean Sea (I changed their names to protect their identities).

They sat on a wharf near Bocas del Toro, Panama, as the sun began to set.

Roberto worked as a business consultant and mathematics professor. Gwen was a chemical engineer. The couple, both 56, retired in 2021. That was when they started living off the proceeds of their combined $2.2 million investment portfolio.

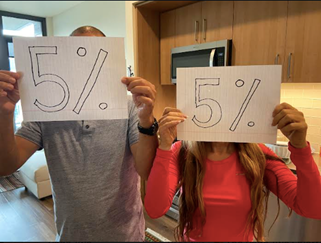

Roberto and Gwen: photo courtesy of Andrew Hallam

Roberto and Gwen: photo courtesy of Andrew Hallam

“Are you following the 4 percent rule?” I asked. They have a globally diversified portfolio of ETFs. If they followed the 4 percent rule, they would have withdrawn $88,000 from their portfolio in the first year of their retirement (2021). That’s because $88,000 is 4 percent of $2.2 million.

Each year that followed, they would withdraw slightly more, to cover the increase in the cost of living.

Roberto and Gwen might be the most financially educated retirees I’ve ever met. Their bedtime reading includes academic journals. They quote retirement planning research the way my nephew quotes football stats.

When I learned they didn’t like the 4 percent rule, I expected them to say they preferred something more conservative, like 3 or 3.5 percent. After all, most research supporting the 4 percent rule (such as William Bengen’s and the so-called Trinity Study) only back-tested portfolios of US stocks. Without intending to, these studies cherry-picked one of the world’s best-performing markets over the past 100 years (after inflation, only Canadian stocks did better).

Professor Wade Pfau’s research was more thorough. His back-tests included US and international markets. He says a sustainable withdrawal rate for a globally diversified portfolio of ETFs should be an inflation-adjusted 3.5 percent, if the retiree expects the money to last at least 30 years.

Roberto and Gwen, however, chose an initial withdrawal rate of 5.2 percent. That might sound like crossing the Atlantic in a kayak. But this couple begs to differ.

“The 4 percent rule has two risks,” says Roberto. “First, there’s a relatively low risk you could run out of money over 30 years. That risk increases if the retirement is long. Second, with the 4 percent rule, there’s an even higher chance that you’ll die with too much money. We wanted something more conservative than the 4 percent rule. But we also wanted the possibility of spending more money.”

Imagine retiring 30 years ago (January 1993) with $1 million. You have a portfolio comprising 65 percent global stocks, 35 percent global bonds. You withdrew an inflation-adjusted 4 percent. Then, sometime in 2023, while you’re binge-watching The Great British Bake Off, you choke on a donut.

And… you’re done. Dead.

Several months later, you look down from the heavens. Your daughter-in-law is walking her dog in the park. Is Fluffy the poodle wearing a big, diamond collar? Yes she is…thanks to all the money you didn’t spend.

You had $1 million when you retired in 1993. You withdrew an inflation-adjusted 4 percent. Thirty years later, you died with $3,692,061.

The 4% rule left too much on the table

1993-2023

65% global stocks, 35% global bonds

|

Year |

Portfolio value at the beginning of each year |

Amount withdrawn |

Portfolio return |

|

1993 |

$1,000,000 |

$40,000 |

18% |

|

1994 |

$1,138,937

|

$41,099 |

-0.18% |

|

1995 |

$1,095,800

|

$42,199 |

21.77% |

|

1996 |

$1,291,078

|

$43,270 |

13.83% |

|

1997 |

$1,426,808 |

$44,708 |

11.11% |

|

1998 |

$1,544,326 |

$45,469 |

16.45% |

|

1999 |

$1,753,395 |

$46,202 |

18.71% |

|

2000 |

$2,032,916 |

$47,442 |

-8.55% |

|

2001 |

$1,811,003 |

$49,049 |

-8.19% |

|

2002 |

$1,614,593 |

$49,810 |

-4.66% |

|

2003 |

$1,487,342 |

$50,994 |

30.60% |

|

2004 |

$1,889,222 |

$51,952 |

14.14% |

|

2005 |

$2,101,208 |

$53,644 |

5.34% |

|

2006 |

$2,155,980 |

$55,476 |

16.42% |

|

2007 |

$2,450,610 |

$56,885 |

9.63% |

|

2008 |

$2,624,991 |

$59,207 |

-29.26% |

|

2009 |

$1,799,534 |

$59,261 |

29.11% |

|

2010 |

$2,260,976 |

$60,874 |

12.06% |

|

2011 |

$2,473,234 |

$61,784 |

-2.86% |

|

2012 |

$2,342,619 |

$63,615 |

13.96% |

|

2013 |

$2,604,574 |

$64,722 |

15.04% |

|

2014 |

$2,914,860 |

$65,694 |

3.03% |

|

2015 |

$2,935,467 |

$66,191 |

-3.03% |

|

2016 |

$2,963,110 |

$66,674 |

6.97% |

|

2017 |

$2,808,149 |

$68,057 |

18.75% |

|

2018 |

$2,937,928 |

$69,493 |

-7.13% |

|

2019 |

$3,417,530 |

$70,820 |

19.45% |

|

2020 |

$3,106,019 |

$72,438 |

15.28% |

|

2021 |

$3,640,600 |

$73,425 |

9.64% |

|

2022 |

$4,126,887 |

$78,591 |

-17.66% |

|

2023 |

$3,527,447 |

$83,664 |

4.67% (to October 1, 2023) |

|

Oct 2023 |

$3,692,061 |

|

|

Source: portfoliovisualizer.com

Roberto and Gwen retired in Panama City, Panama. They rent a penthouse apartment with an ocean view, a gym, a swimming pool and they bought a new car.

Every couple of weeks, they fly to Bocas del Toro. They stay at an upscale chalet, built on a wharf over the Caribbean. “We couldn’t enjoy these things,” says Gwen, “if our spending were restricted to the 4 percent rule.”

Four percent of their $2.2 million portfolio during the first year of their retirement would have been about $88,000. Roberto and Gwen withdrew 5.2 percent: $114,000. At the beginning of 2022, they withdrew $122,450 to align with inflation.

“We’ll cut back during years when the markets drop hard,” said Roberto.

Not surprisingly, Roberto and Gwen studied the research paper, “Decision Rules and Maximum Initial Withdrawal Rates,” by Jonathan Guyton and William J. Klinger.

That paper suggests retirees can begin to withdraw between 5.2 to 5.6 percent, if they have at least 65 percent in stocks. Their research (although entirely US-based) also says that with a dash of flexibility, the money should last at least 40 years. That’s based on the worst-case historical scenario. And it beats the 30 years referenced in the 4 percent rule studies.

Guyton and Klinger say investors could withdraw even more if the markets soar. (For mathematics lovers, I listed the rules at the bottom of the article).

Here’s how the flexible, inflation-adjusted 5.2 percent withdrawals stacked up against the constant, inflation-adjusted 4 percent rule over the past 30 years.

The 4% Rule vs. Guyton and Klinger’s Flexible Formula

1993-2023

65% global stocks, 35% global bonds

(starting with 5.2% withdrawals)

|

Year |

Portfolio value at the beginning of each year |

Amount withdrawn (4% inflation-adjusted) |

|

Portfolio return |

|

Portfolio value at the beginning of each year |

Amount withdrawn (flexible, starting at 5.2%) |

|

1993 |

$1,000,000 |

$40,000 |

|

18.0% |

|

$1,000,000 |

$52,000 |

|

1994 |

$1,138,937 |

$41,099 |

|

-0.18% |

|

$1,126,607 |

$53,429 |

|

1995 |

$1,095,800 |

$42,199 |

|

21.77% |

|

$1,070,821 |

$53,429** |

|

1996 |

$1,291,078 |

$43,270 |

|

13.83% |

|

$1,247,680 |

$56,250 |

|

1997 |

$1,426,808 |

$44,708 |

|

11.11% |

|

$1,362,174 |

$58,120 |

|

1998 |

$1,544,326 |

$45,469 |

|

16.45% |

|

$1,454,341 |

$59,109 |

|

1999 |

$1,753,395 |

$46,202 |

|

18.71% |

|

$1,641,893 |

$66,068* |

|

2000 |

$2,032,916 |

$47,442 |

|

-8.55% |

|

$1,871,126 |

$74,626* |

|

2001 |

$1,811,003 |

$49,049 |

|

-8.19% |

|

$1,633,922 |

$74,626 |

|

2002 |

$1,614,593 |

$49,810 |

|

-4.66% |

|

$1,425,530 |

$74,626 |

|

2003 |

$1,487,342 |

$50,994 |

|

30.60% |

|

$1,284,418 |

$74,626 |

|

2004 |

$1,889,222 |

$51,952 |

|

14.14% |

|

$1,601,457 |

$76,029 |

|

2005 |

$2,101,208 |

$53,644 |

|

5.34% |

|

$1,749,454 |

$77,458 |

|

2006 |

$2,155,980 |

$55,476 |

|

16.42% |

|

$1,761,738 |

$81,186 |

|

2007 |

$2,450,610 |

$56,885 |

|

9.63% |

|

$1,967,687 |

$83,248 |

|

2008 |

$2,624,991 |

$59,207 |

|

-29.26% |

|

$2,070,573 |

$86,646 |

|

2009 |

$1,799,534 |

$59,261 |

|

29.11% |

|

$1,340,523 |

$83,648** |

|

2010 |

$2,260,976 |

$60,874 |

|

12.06% |

|

$1,644,762 |

$85,924 |

|

2011 |

$2,473,234 |

$61,784 |

|

-2.86% |

|

$1,755,924 |

$87,209 |

|

2012 |

$2,342,619 |

$63,615 |

|

13.96% |

|

$1,413,687 |

$87,209 |

|

2013 |

$2,604,574 |

$64,722 |

|

15.04% |

|

$1,522,365 |

$88,727 |

|

2014 |

$2,914,860 |

$65,694 |

|

3.03% |

|

$1,661,322 |

$90,060 |

|

2015 |

$2,935,467 |

$66,191 |

|

-3.03% |

|

$1,620,917 |

$91,403 |

|

2016 |

$2,963,110 |

$66,674 |

|

6.97% |

|

$1,479,795 |

$91,403** |

|

2017 |

$2,808,149 |

$68,057 |

|

18.75% |

|

$1,489,582 |

$92,949 |

|

2018 |

$2,937,928 |

$69,493 |

|

-7.13% |

|

$1,674,018 |

$94,909 |

|

2019 |

$3,417,530 |

$70,820 |

|

19.45% |

|

$1,457,860 |

$94,909** |

|

2020 |

$3,106,019 |

$72,438 |

|

15.28% |

|

$1,584,377 |

$96,202 |

|

2021 |

$3,640,600 |

$73,425 |

|

9.64% |

|

$1,634,206 |

$97,010 |

|

2022 |

$4,126,887 |

$78,591 |

|

-17.66% |

|

$1,687,975 |

$103,836 |

|

2023 |

$3,527,447 |

$83,664 |

|

4.67% |

|

$1,279,404 |

$79,834*** |

|

Oct 2023 |

$3,692,061 |

Total withdrawn $1,675,069 |

|

|

|

$1,339,109 |

Total withdrawn $2,392,082 |

Source: portfoliovisualizer.com and Andrew Hallam for the flexible withdrawals

*Increases in withdrawls beyond inflation (based on the rules at the end of the article)

**No increase in withdrawals, when markets fell the previous year (based on the rules at the end of the article)

***Reductions in withdrawals (based on the rules at the end of the article)

Over these 30 years (1993-2023) retirees using the flexible scheme could have afforded to eat at nicer restaurants, drink better wines and jump out of more airplanes, compared to those who stuck to the 4 percent rule. By withdrawing an initial, inflation-adjusted 5.2 percent, with a flexible plan, retirees would have withdrawn a total of $2.39 million compared to $1.67 million with the 4 percent rule.

And after 30 years of withdrawals, retirees with the flexible withdrawal plan would still have $1,339,109 remaining (by October 2023).

That’s still a lot. But sorry Fluffy the Poodle. You won’t get a diamond collar.

I can hear what you might be thinking. If you withdraw an initial, inflation-adjusted 5.2 percent at the beginning of your retirement, and the markets fall hard, you might be dumpster diving in your eighties.

But Guyton and Klinger suggest not increasing withdrawals during years when the markets drop. They also suggest cutting back, much as Roberto and Gwen plan to, during years when the markets plunge. Once again, I listed the rules at the bottom of the article.

One of the worst times in history to retire would have been in 2000. Stocks fell hard that year. And they fell again in 2001. They slipped even further in 2002. If you retired in 2000, you wouldn’t have seen that coming.

Here’s how your portfolio would have looked, withdrawing an inflation-adjusted 4 percent, versus a flexible 5.2 percent, based on Guyton and Klinger’s rules.

Table 2

The 4% rule vs. Guyton and Klinger’s Flexible Formula

2000-2023

65% global stocks, 35% global bonds

(starting with 5.2% withdrawals)

|

Year |

Portfolio value at the beginning of each year |

Amount withdrawn (4% inflation-adjusted) |

|

Portfolio return |

|

Portfolio value at the beginning of each year |

Amount withdrawn (flexible, starting at 5.2%) |

|

2000 |

$1,000,000 |

$40,000 |

|

-8.55% |

|

$1,000,000 |

$52,000 |

|

2001 |

$873,108 |

$41,355 |

|

-8.19% |

|

$860,702 |

$52,000** |

|

2002 |

$759,632 |

$41,996 |

|

-4.66% |

|

$737,431 |

$46,015*** |

|

2003 |

$681,207 |

$42,995 |

|

30.60% |

|

$655,927 |

$40,929*** |

|

2004 |

$845,872 |

$43,803 |

|

14.14% |

|

$814,961 |

$41,698 |

|

2005 |

$920,279 |

$45,229 |

|

5.34% |

|

$887,169 |

$43,056 |

|

2006 |

$922,674 |

$46,774 |

|

16.42% |

|

$890,042 |

$44,526 |

|

2007 |

$1,026,173 |

$47,962 |

|

9.63% |

|

$990,488 |

$45,658 |

|

2008 |

$1,075,097 |

$49,920 |

|

-29.26% |

|

$1,038,373 |

$47,521 |

|

2009 |

$710,567 |

$49,965 |

|

29.11% |

|

$686,984 |

$42,867 |

|

2010 |

$866,056 |

$51,325 |

|

12.06% |

|

$842,899 |

$44,037 |

|

2011 |

$918,416 |

$52,093 |

|

-2.86% |

|

$899,868 |

$46,016 |

|

2012 |

$838,474 |

$53,636 |

|

13.96% |

|

$828,077 |

$46,016** |

|

2013 |

$900,988 |

$54,569 |

|

15.04% |

|

$896,891 |

$46,817 |

|

2014 |

$981,140 |

$55,389 |

|

3.03% |

|

$984,295 |

$47,520 |

|

2015 |

$955,059 |

$55,808 |

|

-3.03% |

|

$966,238 |

$47,880 |

|

2016 |

$869,942 |

$56,215 |

|

6.97% |

|

$889,118 |

$47,880** |

|

2017 |

$873,163 |

$57,381 |

|

18.75% |

|

$902,183 |

$48,873 |

|

2018 |

$978,318 |

$58,592 |

|

-7.13% |

|

$1,021,468 |

$49,904 |

|

2019 |

$848,808 |

$59,711 |

|

19.45% |

|

$897,732 |

$49,904** |

|

2020 |

$952,835 |

$61,075 |

|

15.28% |

|

$1,021,307 |

$51,044 |

|

2021 |

$1,036,493 |

$61,907 |

|

9.64% |

|

$1,125,593 |

$51,740 |

|

2022 |

$1,070,191 |

$66,263 |

|

-17.66% |

|

$1,178,767 |

$55,380 |

|

2023 |

$810,695 |

$70,540 |

|

4.67% |

|

$911,687 |

$55,380 |

|

Portfolio value October 2023: $848,528 |

Total withdrawn $1,264,503 |

|

|

|

Portfolio value October 2023: $954,232 |

Total withdrawn $1,097,781 |

Source: portfoliovisualizer.com and Andrew Hallam for the flexible withdrawals

**No increase in withdrawals, when markets fell the previous year (based on the rules at the end of the article)

***Reductions in withdrawals (based on the rules at the end of the article)

“Research suggests the first few years of retirement are usually the most expensive,” says Gwen. “If someone is going to travel the world or splash out on mid-week dining, that’s often when they do it.”

And if the portfolio crashes hard in those first few years?

Check out Table 2.

With the flexible, inflation-adjusted 5.2 percent, the investor was able to spend more money over the first three years, compared to someone sticking to the 4 percent rule.

But as shown, they pulled back on withdrawals as stocks kept falling.

Thanks to those pullbacks, anyone following Guyton and Klinger’s rules from the year 2000 would have more money remaining by October 2023, compared to someone who stuck to a 4 percent inflation-adjusted plan. In other words, it would have been “safer” than the 4 percent rule.

Guyton, Klinger, Roberto and Gwen aren’t the only people recommending flexible withdrawals, instead of the 4 percent rule. Vanguard does as well. Nobel Prize winning economist, William F. Sharpe, says much the same thing.

I asked Roberto and Gwen whether reduced withdrawals (such as those shown in Table 2) would impinge their lifestyle. They just smiled.

“We would just move to Thailand,” Gwen said, “and live even better on less.”

Guyton and Klinger’s Rules

(As applied in Tables 1 and 2)

- Begin withdrawing 5.2% to 5.6% of the portfolio’s value during the first year of retirement. In Tables 1 and 2, I withdrew the money at the beginning of each year.

- Make upward adjustments to match inflation. In Tables 1 and 2, I did this to match the previous year’s inflation rate.

- If the markets dropped the previous year, don’t increase withdrawals in the year that follows.

- Reducing Withdrawals: If the portfolio falls especially hard, don’t let the withdrawn amount exceed 20 percent of the initial withdrawal rate. For example, note the year 2002, in Table 2. At the beginning of that year, the portfolio was valued at $737,431. Recall that when this person first retired (in 2000) the initial withdrawal rate was 5.2%. If we add 20% to 5.2%, we get 6.24%. This means the scheduled withdrawal in 2002 should not exceed 6.24% of the portfolio’s value at the beginning of 2002: $737,431. But it would have, if we didn’t reduce the withdrawal. That’s why the withdrawal in 2001 was $52,000 and the withdrawal in 2002 was $46,015. That figure ($46,015) was chosen because it was 6.24% of the portfolio’s value ($737,431) that year.

- Boosting Withdrawals Further Than Inflation: When the amount withdrawn would be 20 percent below the initial withdrawal rate, the investor boosts their withdrawal by 10%. For example, the initial withdrawal rate was 5.2%. In Table 1, you can see that the portfolio’s value at the beginning of 1998: $1,454,341. The scheduled withdrawal was meant to be just north of $59,109. But $59,109 is just 4.06% of $1,454,341. And 4.06% is about 22% lower than the initial withdrawal rate of 5.2%. In such cases, the retiree should give themselves a 10 percent pay raise. That’s why the withdrawal in 1998 was $59,109 and the withdrawal in 1999 was $66,068. At the beginning of 2000, the withdrawal increased to $74,626 for the same reason.

Andrew Hallam is the best-selling author of Millionaire Expat (3rd edition), Balance, and Millionaire Teacher.