This morning I flicked through Sky News on my iPhone…

While waiting in line at Starbucks.

In 10 minutes, I interacted with 3 companies on the stock market.

There’ll be hundreds more throughout the day…

Why am I telling you this?

I’m currently typing this on Microsoft Word.

Later tonight, I’ll try and catch my favourite show on Netflix…

(One of the biggest companies on the stock market).

The stock market surrounds us all day, every day.

We are sitting, standing, driving, eating and sleeping in it.

Interesting perspective, isn’t it?

The real question is, how can we make it work for us?

(Hat tip to the Maven Money podcast for this).

Simply put, the stock market is a collection of companies.

The stock market goes up as businesses raise their prices, which in turn raise their profits and the amount of money they pay out to shareholders in the form of dividends.

Shares rise in price as their future expected value slowly increases over time.

So, buying a share is really an exchange of expectation that we can sell them for more in the future.

Almost every company, big and small, is surrounded by the stock market.

Even if they’re not listed (like IKEA for example)…

They use the services or products of other listed companies like Mastercard or Visa.

The stock market’s reach is almost incomprehensible.

So, how can we take advantage of the stock market’s power to maximise our own wealth?

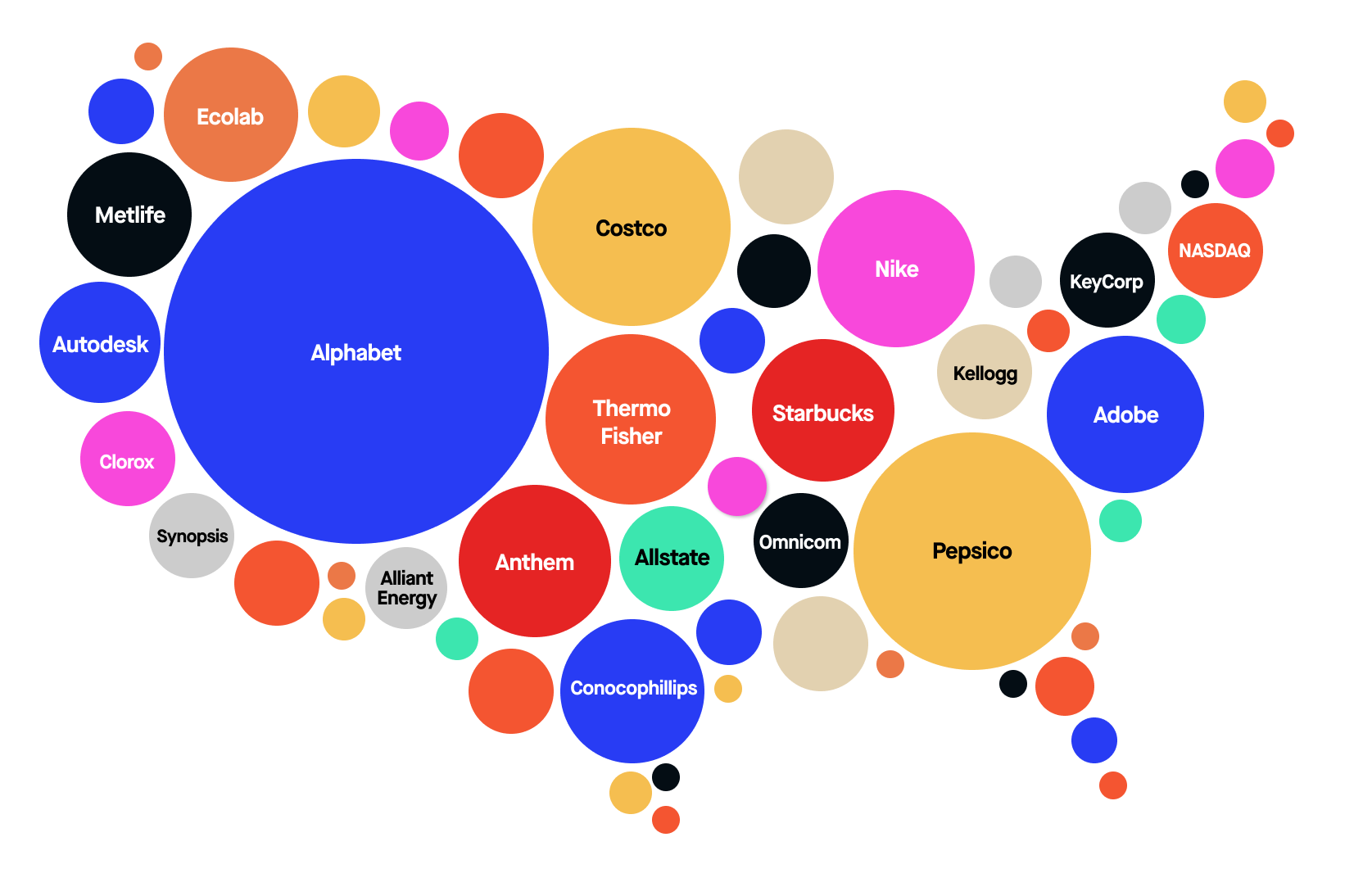

1. Global diversification

The first way is through a globally diversified portfolio.

The funds we invest our clients’ money in have thousands of companies in each.

The funds we invest our clients’ money in have thousands of companies in each.

Every month, some companies will drop out, go private, be sold, or die…

But regardless, the entire fund won’t be affected because there are so many companies in them.

By investing globally, you’re further safeguarding your money.

Not concentrating your money in one fund or country means your money’s practically unaffected by any political or economic events.

Then there are funds that take all this even further.

Like Dimensional Funds, these are designed to maximise growth by buying every stock that could potentially bring higher long-term returns.

In other words – stocks most likely to generate an investment premium.

On average, the long-term returns of the stock market have been around 10%.

Inflation in developed markets is around 4%...

Meaning investors’ returns are typically 6% above inflation.

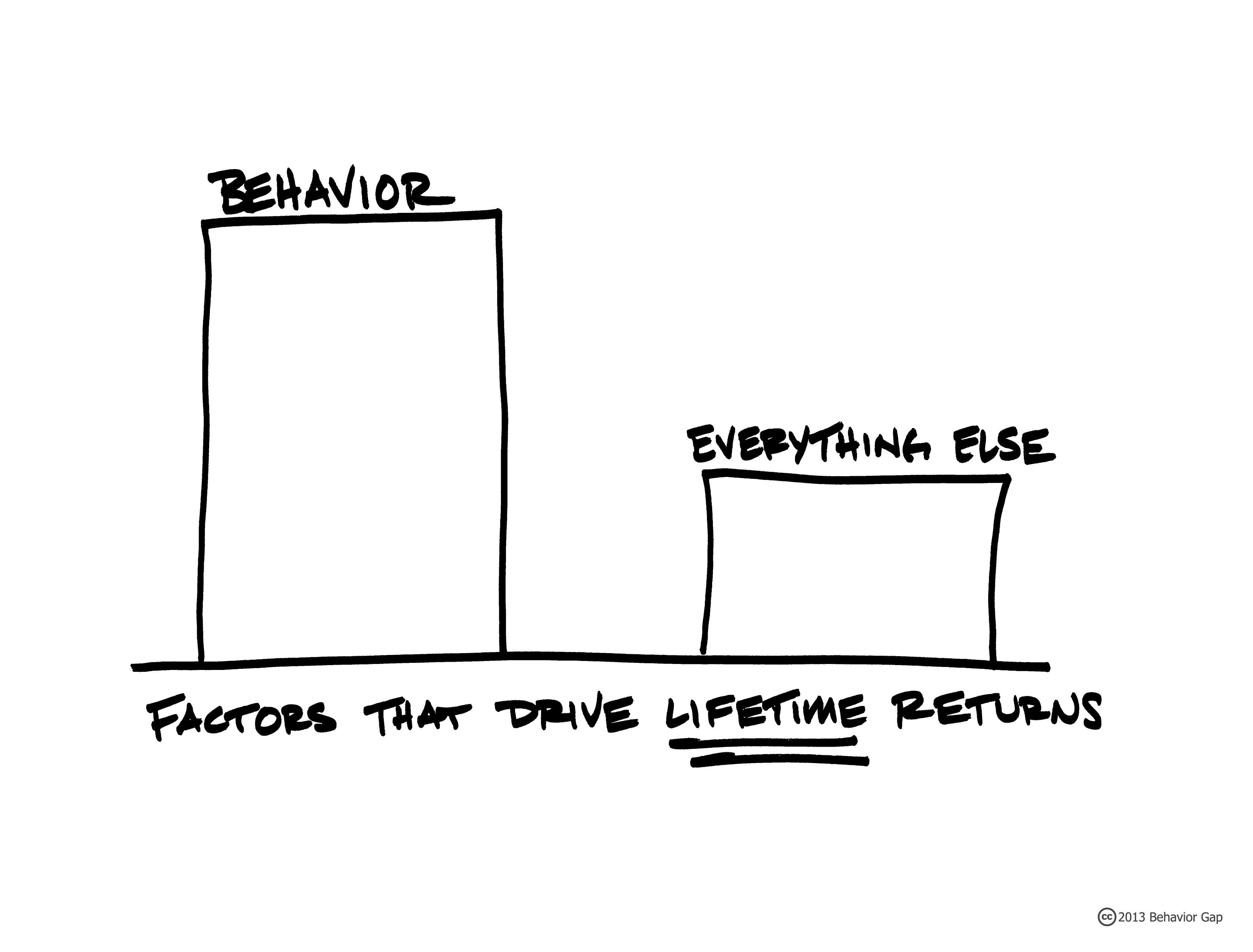

2. Discipline

But very few people get these returns because they react.

They allow their emotions and biases to affect their decision making by buying and selling at completely the wrong times.

Ask yourself…

Will you be able to do absolutely nothing when the next market crash comes?

Working and living in Dubai, I’ve had my fair share of fire drills.

Fire safety is of the utmost importance in this skyscraper city.

The drills prepare you for a fire before it happens.

They remind us that if it does, the best thing to do is stay calm.

Don’t panic.

Follow the rules and you’ll be okay.

It’s the same for investors.

Those who remain disciplined when the markets test us will be richly rewarded over the long term.

As Andy Hart from the Maven Money podcast puts it:

“Behave your way to wealth.

Misbehave your way to poverty.”

Simple in theory but more challenging in practice.

3. Power of compounding

6% in any given year doesn’t feel like much in the moment.

However, small gains add up over time.

This is one of the reasons it’s so difficult for investors to stick with a long-term plan. You don’t see much in the way of significant investment gains for some time.

Combine that with market volatility and it's easy to see why investors panic.

The good news is you don’t need to go about it alone.

A financial adviser is so much more than just a money manager.

They can be your behavioural coach when you need it.

Blowing the whistle on any emotional or biased decisions you may make…

Helping you stay calm and confident…

And keeping you on track towards your goals.

Harness the power of the stock market today.

The next time you brush your teeth, buy a new gadget, or interact with any big-name brands in any way…

Remember, they could be working for you.

To increase your returns and improve your financial future.