How to avoid the silent pension killer [plus 2 other ways to ensure you don't outlive your money]

![How to avoid the silent pension killer [plus 2 other ways to ensure you don't outlive your money]](https://www.aesinternational.com/hubfs/Blog%20header_silent%20pension%20killer.jpg)

![How to avoid the silent pension killer [plus 2 other ways to ensure you don't outlive your money]](https://www.aesinternational.com/hubfs/Blog%20header_silent%20pension%20killer.jpg)

If you're nearing retirement, you probably have a lot on your mind.

What will you do with all that spare time?

How many holidays can you afford?

Will your money last, even if you live longer than expected?

The only way to answer these questions is to make sure your investment portfolio is steadily growing and working for you.

I read a fascinating report the other day by Raconteur.

It covered various aspects of retirement.

And included many facts about the changing landscape of retirement.

Truth is, times have changed.

People are working longer to fund their retirements.

And that's not particularly a bad thing.

With growing concerns around retirement, working longer is one way to ease anxiety.

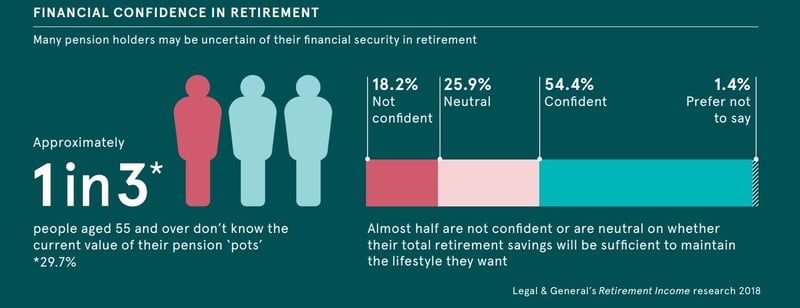

Especially for almost 50% of pension holders in the UK who admit they lack confidence in their financial security.

Earning a salary for just a few more years could greatly impact your ability to afford quality healthcare, your current standard of living, overseas trips and a few, well-deserved luxuries.

After all, retirement aspirations can be costly.

Moreover, with everyone living longer than ever, people are also healthier than ever.

Often working past retirement age is a choice.

People are happy to continue their contributions to the workplace...

And organisations are finding immense value in having a multi-generational workforce working side by side.

I'm telling you this to show you that the news of longevity and people working longer to fund their retirements is not necessarily doom and gloom.

It's just another way the world is evolving.

Retirement - including everyone's perception of it - is changing.

On the topic of change...

As you etch closer to retirement - ideally at least five years away - there are steps to take to ensure your portfolio is still working hard for you.

More than likely this will require changes to your portfolio.

Here are 3 ways to get the clarity and confidence you need to control your financial future...

1. De-risk your portfolio

Your financial planner should help move you out of higher risk stocks and shares and into things like government bonds.

While high risk works in your favour when you have time on your side, it has the opposite effect as you near retirement.

That's because any losses faced due to stock market falls (like those seen in 2008)...

Won't have time to recover.

![]()

2. Avoid guarantees and promises, particularly later on in life

Another common mistake made by those approaching retirement, particularly expatriates, is to take the advice of a salesperson and begin investing in high-risk investments.

They may promise “investment guarantees” and even “capital protection”.

But a fiduciary will never guarantee you a return, as they know they can’t.

No one knows what the markets will do or how will an investment will perform.

Years of studies by Nobel Prize-winners have proven that.

One or two poor investment decisions made later on, can decimate a portfolio.

And leave no time to recover.

3. Remember the silent pension killer

As you go through your retirement you also need to watch out for the silent pension killer, inflation.

Leaving money in cash may seem less risky, but it's not a viable option, particularly if you are planning a long retirement.

With inflation, the real value of your money will continue to fall over time.

Say inflation was 3%...

Someone retiring at 55 with a pension pot of £500,000 and taking a retirement income of £17,500 per year, would run out of money before their 80th birthday.

To put this into context the average pension pot in the UK at retirement is around £35,000.

Having a globally diversified portfolio, with low-cost funds that's in tune with your attitude to risk, is the best "guarantee" any investor can have.

You can read more about that here.

Investing for retirement is a systematic and consistent commitment.

It requires years of focus.

With time on your side, you can recover from any potential mistakes.

(After all, every investor makes them).

And market volatility is less likely to erode the value of your investment...

As it still has time to grow.

But when your retirement is near, safeguarding your wealth is key especially when it comes to your pension.

If you need any help at all with your pension or investments, get in touch.

You'll be placing your financial future in good hands.