Recently, I read a book titled: How to Think about Money

The final chapter was particularly interesting.

So I thought I’d share a summary of it in 10 simple points.

As a child, I never thought about money.

As a teenager, I was thinking about spending it.

Now as an adult, I want to make money and grow it.

It’s funny how our perceptions of money change over time.

This book really put them into perspective.

I’m sure some will hit home for you too.

1. Possessions vs experiences

We tend to favour possessions with lasting value.

But often we get greater happiness when we spend our money on experiences.

Take your family to Paris instead, or Disneyworld.

Eat good food, take thousands of photos, immerse yourself in the culture and come back with priceless memories.

2. Treat your friends and family

We should use our money to treat loved ones.

Take the kids for a ski holiday, buy them a new skateboard.

Take your spouse to the theatre or spoil them with last-minute surprises.

When your friends are in town, take them out for dinner, show them the sights.

Life is short – show people you appreciate them.

3. Spend your days doing what you love

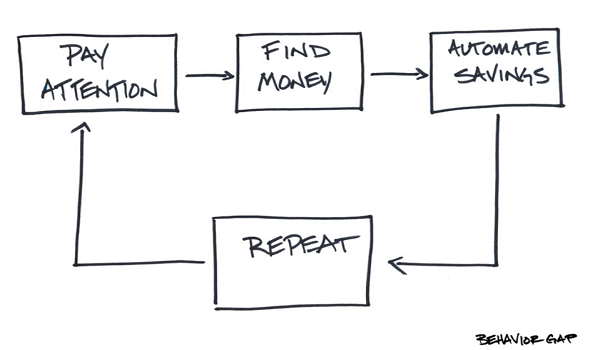

Save all you can – from as early as possible.

The end goal is to quickly buy yourself financial freedom.

So you can do things that may not be as lucrative, as they are meaningful.

Saving consistently could mean that within a few years you could spend more time doing things you love.

And that brings purpose to your lives.

4. Plan for a longer life

You should worry less about dying early in retirement.

People are living longer than ever before.

That means you need to save more than your predecessors ever did.

You could easily be retired for more than 40 years.

So while longevity is great news and allows you to see and do more in your lifetime…

It also means you have an obligation to save more aggressively today.

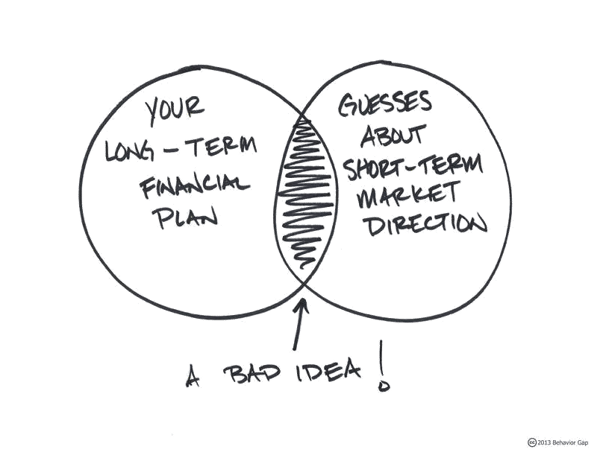

5. Invest for the long term

Your investment time horizon is not measured in weeks and months.

It’s measured in years and decades.

Look beyond the market’s short-term fluctuations.

A globally diversified portfolio invested in the world’s greatest companies should cushion against sudden blows and allow you to accrue fantastic gains if you stay invested for many years.

6. Cut down on fixed monthly costs

Mortgages, cars, utilities, insurance premiums.

All these are fixed monthly costs, which should amount to no more than 50% of your income.

By cutting down on these, you’ll free up more money and have more leeway for emergency costs and discretionary spending.

7. Stop trying to beat the market

The harder you try to beat the market, the more likely you are to fail.

Buying high and selling low can incur huge costs.

Not to mention, have detrimental effects on savings.

The best way to avoid this is to stay invested and keep focused on your long-term goals.

8. Don't be alarmed by market declines

Stocks have fundamental value.

For a diversified portfolio, that fundamental value will change much more slowly than market prices.

You need to focus on the dividends and earnings you buy with every dollar, pound or euro invested.

Always remember that over the long run, you will reap rewards.

And that when the market declines, it’s the best time to buy.

9. Your ultimate goal

Retirement may be your life’s final financial goal.

But it should be one of your first priorities.

It’s the most expensive goal so it requires more consistent saving over a longer period of time.

It’s also vastly different from other savings goals.

Like buying a home or paying for your child’s education.

It’s not an option.

And you can’t expect to pay for it with a paycheque.

10. Redefine your goal

Your goal shouldn’t be to get rich.

Rather, it should be to have enough money to lead the life you want.

You shouldn’t take on risk you’re not comfortable with.

Or stray too far from a global indexing strategy.

As your perceptions of money changes, so do your goals.

Your financial plan should reflect this.

If it’s time to revisit your current portfolio, get in touch.