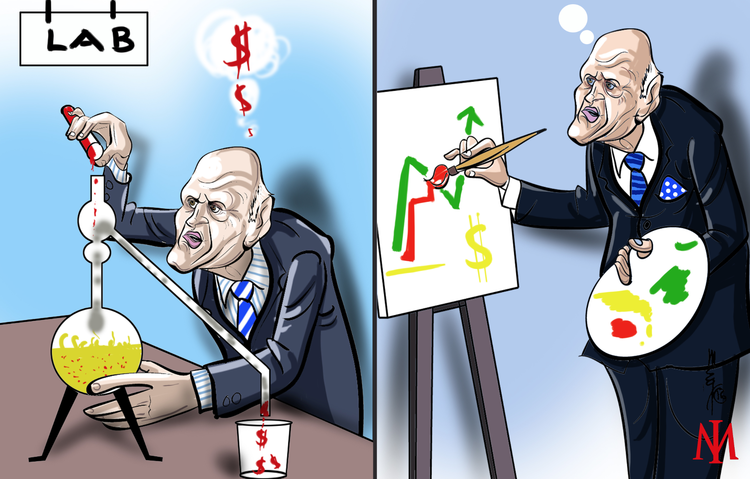

Is investing a science or an art? It's both. If you disagree, read this. By the end, we will see eye to eye.

Most fields outside of academia are a balance of science and art.

Including investing.

It’s human and emotional.

Yet based on data, years of research and evidence.

Who disagrees?

The psychological part of investing (involving your emotions, expectations, attitudes and habits) is crucial.

But it won’t be successful without objective research into market history.

That’s the science.

In 2013, investment author Dan Solin wrote:

“Investing is science. Advisers who understand the science of investing know that returns are the product of risk. Some risks are worth taking, while others are not.”

On the contrary, American investor Peter Lynch once said:

“Investing in stocks is an art, not a science, and people who’ve been trained to rigidly quantify everything have a big disadvantage.”

I personally believe investing is equal parts science and art.

Take Dimensional Fund Advisors for example.

They rely on some of the best academic brains on the planet to manage over half a trillion dollars using exhaustive research and cutting-edge strategies to squeeze maximum returns from various stock indexes. That’s science.

But DFA’s success can also be attributed to a form of art.

The company’s funds are available to individuals, but only those who are clients of advisory firms that share DFA’s beliefs.

It’s a genius model I’ve discussed in-depth before.

A kind of next-generation thinking that can only be defined as art.

Helping investors to stay the course and maximise their returns…

Ensuring they get tailored, diversified portfolios and plans based on their unique life goals.

Yes, they get investment reviews and risk appropriate solutions…

But perhaps more importantly they get a sense of relief when it comes to the anxiety around money.

A feeling of confidence and empowerment.

The opportunity to feel good about their wealth and their future.

This is all about emotion.

All of which, is human…

Art.

I believe the science of investing must be based on the evidence that no investor can reliably predict the markets. If you disagree with that, we can’t help you.

While the past cannot determine future performance, it can tell us the probabilities of various investment outcomes.

Investors are heavily influenced by the financial media and salespeople.

And the constant stream of messages we’re bombarded with daily, like…

Invest now.

Buy this now.

Yet there is no evidence at all proving the products Wall Street wants us to buy…

Our brother-in-law brags about…

Our golf buddies ‘swear by’…

Or news outlets call the ‘next best investment’…

Will be in our best interest.

Educating yourself on the world of investment management is science.

But filtering out the noise is an art.

I don’t think the art vs. science debate will be over any time soon.

But ultimately you shouldn’t have one extreme or the other.

Like everything else in investing, balance is key.

If you’re looking for an adviser who shows you the evidence not the spin…

And who understands your life goals are more important than Bitcoin gains…

You know where to find us.