7 simple ways to avoid UK inheritance tax in 2023 [plus a case study]

![7 simple ways to avoid UK inheritance tax in 2023 [plus a case study]](https://www.aesinternational.com/hubfs/7%20simple%20ways%20to%20avoid%20IHT%20header.jpg)

![7 simple ways to avoid UK inheritance tax in 2023 [plus a case study]](https://www.aesinternational.com/hubfs/7%20simple%20ways%20to%20avoid%20IHT%20header.jpg)

One of the best descriptions of inheritance tax (IHT) was written by British politician Roy Jenkins:

“It is a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue…”

Brilliant!

Before we go any further, it's worth noting the update from the 2022 Autumn Statement, stating that the inheritance tax (IHT) thresholds will be fixed at their current levels for tax years 2026 to 2027 and 2027 to 2028. This measure will fix the Nil Rate Band at £325,000 for at least the next five years.

But, there are ways to save your estate being eroded by IHT. Here are seven:

1. Spouse and civil partner exemptions

Married couples and civil partners can make use of each other’s tax-free allowance without special tax planning.

Gifts and transfers between most married couples and civil partners living in the UK are IHT-free, so if the first partner to die leaves their entire estate to the other, no tax will be payable.

It's also likely that none of their nil-rate band has been used, and the partner will be able to add the unused balance to their own, effectively doubling the threshold.

If your partner is not UK-domiciled however, limits can apply, and you should seek advice.

By transferring everything on first death to the surviving partner you won’t entirely remove your estate’s vulnerability to IHT.

The IHT liability will arise when the second partner dies…

So, it may be effective to pass some of your estate to your children and grandchildren - up to the Nil Rate Band (the amount you can leave tax-free), or by using a trust - rather than simply transferring everything to the surviving spouse.

2. Annual exemption

Each tax year, you can give away some money or possessions free of Inheritance Tax. How much is tax free depends on which allowances you use.

Inheritance Tax may have to be paid after your death on some gifts you’ve given.

Every person is allowed to make an IHT-free gift of up to £3,000 in any tax year – and this allowance can be carried forward one year if you don’t use up all your allowance.

This means you and your partner could gift your children or grandchildren £6,000 this year, (or £12,000 if your previous year’s allowances weren’t used up), and that gift won’t incur IHT.

You can continue to make this gift annually.

3. Small gift exemption

You are able to make small gifts of up to £250 per year to anyone you like.

There is no limit to the number of recipients in one tax year, and these small gifts will also be IHT-free, provided you have made no other gifts to that person during the tax year.

4. Lifetime gifts exemption

Lifetime gifts are those made by you while you’re still alive.

Gifts given less than 7 years before you die may be taxed depending on:

- who you give the gift to and their relationship to you;

- the value of the gift;

- when the gift was given.

It's best to seek professional advice about what you can give away tax free during your lifetime.

Gifts include money, household and personal goods, a house, land or buildings, stocks and shares listed on the LSE or unlisted shares you held for less than 2 years before your death.

If such gifts are made to help with another person’s living costs, e.g. an elderly relative or child, they are free from IHT.

Other lifetime gifts may be exempt as long as you make them regularly (e.g., annually), and they come from your regular income, (such as pensions, dividends, interest from investments etc.), without affecting your lifestyle.

There’s an important caveat however!

Determining whether such a gift is exempt only happens after your death, and is subjective…

There’s a risk some gifts may be classed as being within your estate for IHT purposes if the taxman decides they did affect your lifestyle for example; therefore, if you are making habitual gifts it's important to document your intentions and keep a record of this with your will.

5. Marriage or civil partnership gifts exemption

If someone you know is getting married or entering into a civil partnership, you can give them a financial gift IHT free.

The amount you can gift depends on your relationship to the recipient:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to any other person

6. IHT-free bequests

Gifts or bequests to charities, political parties, universities and for national purpose or public benefit are IHT exempt.

7. Business owner exemptions

If you’re a business owner, you may be eligible for certain tax reliefs, depending on the type of business you own.

Often, a transfer made during life or on death will be completely IHT free.

You can get 100% Business Relief (subject to minimum periods of ownership) on:

- a business or interest in a business

- shares in an unlisted company

You can get 50% Business Relief on:

- shares controlling more than 50% of the voting rights in a listed company

- land, buildings or machinery owned by the deceased and used in a business they were a partner in or controlled

- land, buildings or machinery used in the business and held in a trust that it has the right to benefit from

It's worth noting that you can only get the above-mentioned tax reliefs if the deceased owned the business or assets for at least 2 years before death.

For those looking to pass on agricultural property free of IHT, this is possible if:

- the person who owned the land farmed it themselves

- the land was used by someone else on a short-term grazing licence

- it was let on a tenancy that began on or after 1 September 1995

A property owned before 10th March 1981 can also qualify for 100% relief if:

- it would've qualified under Schedule 8 Finance Act 1975 had it been transferred before that date

- the owner had no possible right to vacant possession between that date and the current date of transfer

In any other case, relief is due at a lower rate of 50%.

There are many instances where Business Relief cannot be claimed, so speak to your financial planner before making any decisions.

Case study: How a financial planner can set you up for the future and mitigate IHT

Below is a case study of a client and her husband.

We met them to discuss their plans for the future.

With a young daughter, they were conscious their lifestyles may not be working in their favour in the long run.

And they wanted to make sure they were not only properly set up for retirement but also able to leave a legacy for their daughter - all while minimising their IHT bill.

Here's a quick summary of their circumstances:

- They are in their late 40s and had never taken financial advice before

- Between them, they have two UK pensions

- They live in Dubai, travelling the world and living in one of the most sought-after beachfront suburbs

- Their daughter is 7 and at a private school

- The wife is the primary breadwinner and the husband is a freelancer

- They recently sold their UK property and need help investing the cash

- Combined, their liquid investments were valued at £750,000

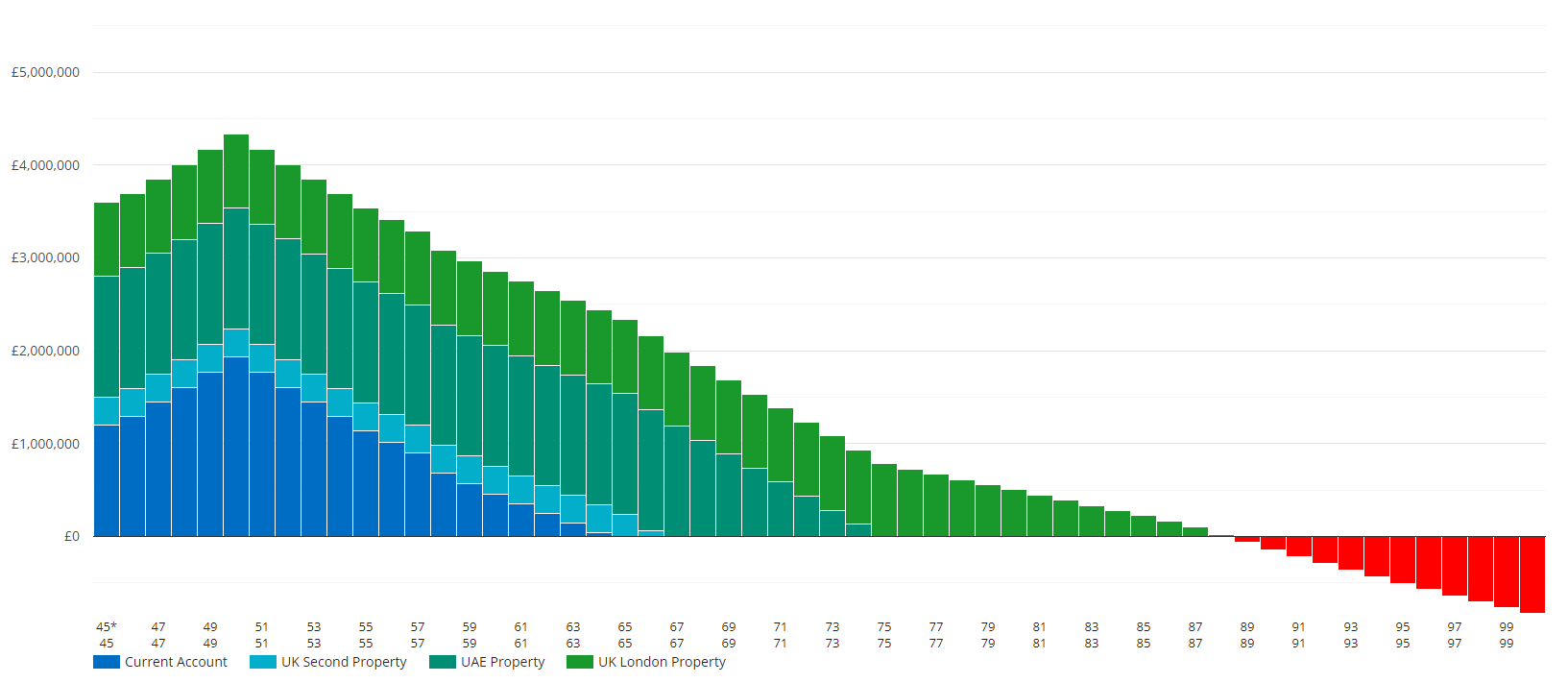

We ran a cash flow model to better understand their finances and it became clear that, if they continued spending the way they do...

They'll run out of money before they turn 70.

A cash flow model might look like this:

Considering they're both fit and healthy, they'd need their money to last until they're at least in their 90s.

So they needed a proper financial plan to make sure that happened.

Here's what their plan included

- They reduced their monthly spending by 20% which allowed them to cut excessive expenditure while maintaining their high-quality lifestyle

- A low-cost investment account was opened so they could get their cash working for them

- Additional voluntary contributions were recommended to gap-fill previous years and ongoing contributions moving forwards

- Their daughter will be taken care of later in life with a sizeable inheritance of $1.1 million, inheritance tax free

Because of their solid financial plan, including strategies to mitigate IHT, the couple is on track to achieve their retirement goals.

In addition, they're able to continue their way of life while knowing their daughter will be taken care of when she's older.

These are just some of the ways you can use clever financial planning to cut your IHT bill down to size.

Depending on your personal circumstances, you may be able to use a trust or trusts, wrapping assets and investments like an offshore investment bond inside, and further reduce your estate’s future liability.

But it's always best to work with a financial planner on this.

Here are 3 more useful resources for you, if you’re interested in gathering more information: -

- Your 2023 expat guide to property tax in the UK

- How to save £264,800 of inheritance tax in 4 minutes

- 5 simple, most tax-efficient way to distribute wealth to your family

Additionally, if you're looking for more information as a high-net-worth investor, you may find this page useful.