Every family of wealth needs a financial plan.

In fact, an investment in a solid, thoughtful plan will pay dividends long into the future.

If you have significant net worth and aren’t sure if a financial/cash flow plan is worth the effort, keep reading.

There are many benefits to a financial plan.

It allows you to build a roadmap to achieve your goals, and a framework to make sensible decisions over the course of your lifetime.

And “over the course of your lifetime” is key.

A good plan should last a long time but must be monitored and updated to reflect life transitions.

In this blog I'll list some critical planning principles.

They'll not only ensure you have enough money to do all the things you want to do during your life, but also after you're gone...

Planning for the succession of your wealth, whether it be to future generations or to philanthropic causes.

The result?

You'll be left with a plan which identifies gaps in your strategy, and allows you to fix them before it's too late.

Goals and objectives

For your financial plan to work, the starting point is understanding what you are trying to achieve.

Let's explore this a little further.

What is the wealth for?

For most families, it's to ensure they can live the life they want to live. Once you've decided what that life looks like, you have to decide what portion of your wealth it'll take to fund it.

Goals generally include your lifestyle expenses, capital purchases and helping out family members.

Many of my clients have more than enough money to live the life they want, but they also want to build more, perhaps to give more, to philanthropic causes for example.

This is an important part of building a plan.

Deciding how wealth will be given away, not just built, requires time.

Who is the wealth for?

There are really only two things you do with money. Spend it and give it away.

You do this either while alive, or after you have passed, either to children, grandchildren, friends, charity, or the government.

When will they receive it?

The key here is to balance helping others with your own needs. Giving away too much, too soon, might leave yourself short. Think about how much you might need as a safety net - this can help identify what you are free to give away.

How much will (and should) they get?

This is a common question I am asked by wealthy parents and grandparents.

They want to help, but not hinder.

Giving away too much can stifle development, as well as leave children with a lack of purpose and self-esteem.

The numbers

Now that we have looked at goals, including the what, who, when and how of your financial plan, it's time to look at the numbers.

Every financial plan has many data inputs and assumptions.

The more accurate, realistic and current these are, the better the plan will be.

There are some steps to consider here:

- Your family's assets and liabilities - cash, securities, property, companies, business cash flow and potential inheritances are your assets. Liabilities are unlikely to be debt, but rather the goals the family wants to achieve which need to be funded. The difference between the assets and liabilities is therefore the family net worth.

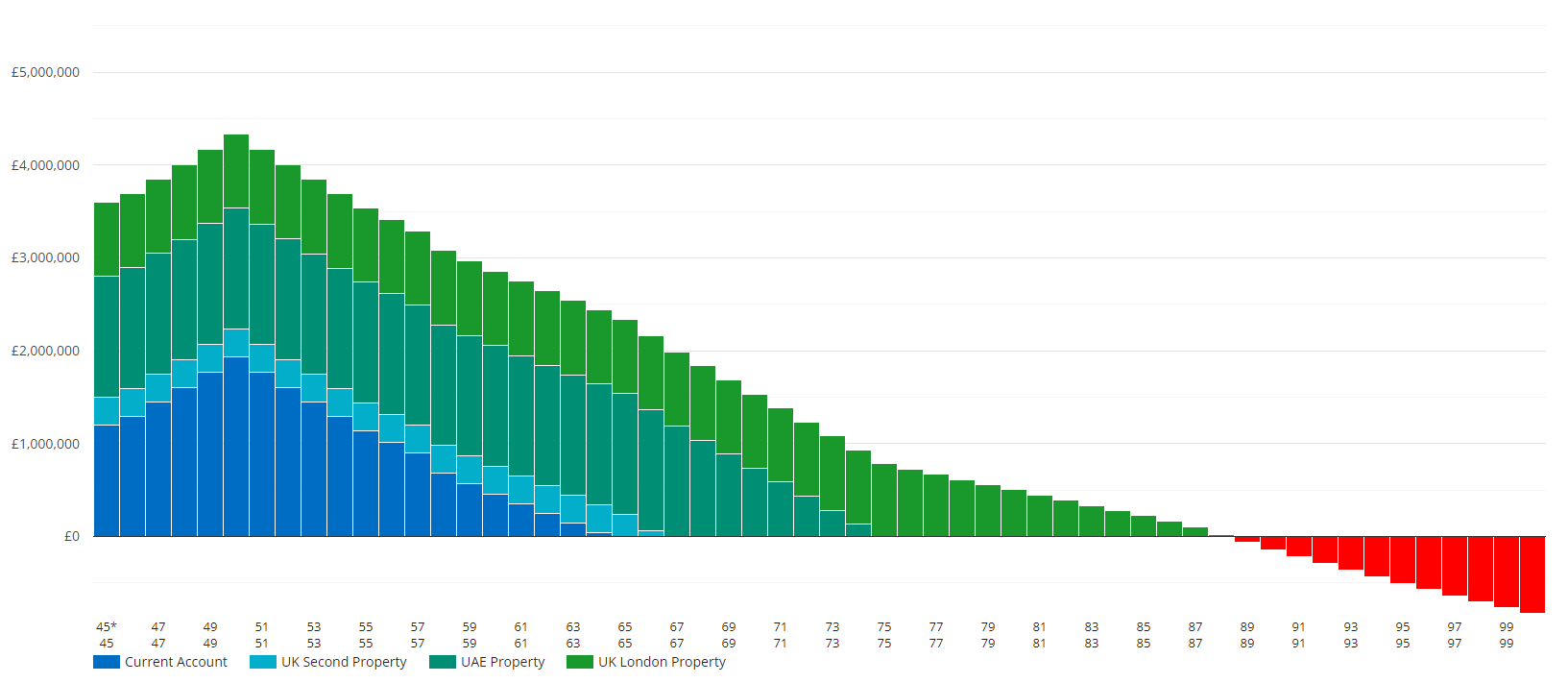

- Your family's income statement - gross income, less taxes, less expenses. Most people know what their income is, and tax can be calculated. Calculating expenses however, is trickier. For my clients, I take all the data they can provide on income, taxes and saving, and plot this into a cash flow model (factoring in assumptions like inflation, interest rates, life expectancy, years of work, number of dependants, etc.).

I prefer to use conservative assumptions and be pleasantly surprised (as opposed to the opposite).

Of course, not all clients are happy with the output of their cash flow and want to tweak some of the inputs to improve their results.

This is great, and should be done until you feel comfortable.

You can change:

- Income - including positive cash flow from employment, your business or your portfolio.

- Expenses - arguably the most important input to a cash flow forecast.

- Time - how long you'll work and have income, as well as life expectancy.

- Other assets - they don’t produce income right now, but could be sold later.

Focus on what you can control

Hoping for higher rates of return on investments is something you can't control.

Your spending is something you can.

Most families don't want to spend less, but they can sometimes adjust to make a plan work.

Now it's time to analyse the pros and cons of each of your outcomes.

Which scenario is most likely to achieve your and your family’s goals?

This is where the real value of the plan comes in.

A cash flow analysis can also highlight unexpected outcomes.

For some, it might show they have too much money - which may lead them to make different decisions, perhaps about philanthropy.

For others, it might show too little money to keep up with their current spending patterns. A change needs to be made to avoid running out of money in retirement.

For some, things might be 'just right' and all that is needed is someone to keep them on the path towards their ideal future.

The plan doesn't stop there

With your best cash flow scenario chosen, the next step is to include the tax, investment, and estate planning components.

Some examples might be:

- Tax planning - done correctly, this can significantly increase investor returns.

- Investment planning - once you know what you need to make your plan work, building a low-cost portfolio invested in the world's best companies (and which links back to your goals) is much easier.

- Estate planning - this relates back to the who, when, how questions above.

- Life insurance. Insurance should be addressed in the plan, but not everyone needs it (for example, if your assets exceed your goals). Your financial planner can help you more here.

- Administration - a critical part of any financial plan is documentation, not least so that the plan can be followed after you die.

After implementing your plan (after all, it would be a waste of time if you didn't), the next step is to review and adjust.

Major changes in life such as births, deaths, marriages, divorces, should cause you to review.

It's a dynamic document.

Your life rarely moves in straight lines on smooth roads.

Recent events in our world provide a dramatic reminder that the unexpected and unplanned can force a rethink of even the most locked-in goals.

You should take comfort in knowing you have done all your homework, used realistic and conservative numbers, and you are making the best decisions you can at the time with the information you have.

For me, the biggest benefits of a plan are the direction and perspective it provides.

This can give a feeling of clarity, confidence and control, usually meaning better outcomes and fewer mistakes.

A plan is more than just financial advice.

It’s about a highly personalised, tailored approach to planning your life in numbers.

It's a living and breathing creation that begins with each person’s goals and aspirations and works back from there.

You could think of a financial plan as a tapestry.

It's composed of many individual panels woven together into a whole.

The goals determine the strategy, not vice versa.

In some ways, it's never finished.

But starting it will be one of the best decisions your family can ever make.